In the Housing Market, You Need a Higher Income to Get a Lower Payment Plan

We all know that it takes money to make money. This somewhat cliche catchphrase has been drilled into our heads since we were children. Half an incentive to make us strive, half a warning to keep our hopes from hot air ballooning into untouchable territory. It seems the idea that finances are the launching pad to more finances has prevailed across generations. What many people in this day and age are largely unaware of, however, is the fact that it also takes money to save money.

These two conditions might sound similar initially, but they are much different regarding functionality in the real world. In truth, less than 10% of Americans are wealthy. With income inequality skyrocketing amid the ashes of the COVID-19 crisis, that number is likely to shrink even further. Due to this, the number of US workers who need to make money to make money would realistically become fewer in the near future.

As we shift into an unsteady employment climate, an uncertain economy, and an outrageous housing market, it is the need to save money that should be emphasized, even over the need to make money.

The most recent public health scare has certainly taught us how precarious our situation is and how vulnerable to homelessness the average working-class American has become. Armed with the knowledge that approximately 59% of US citizens are now just one measly paycheck away from homelessness, we should ideally be living life like ants on a hill, stockpiling our modest gains for inclement weather. Economists tell us the inflation storm is already here, but there’s a problem hovering over us.

If We’re Honest, Most Working-Class People Are Too Poor to Save Anything

The world was in utter shock when the pandemic gave us an unexpected glimpse into American workers’ bank accounts, revealing that 69% of us did not have even $1,000 in the bank. In fact, a whopping 45% of us had zero dollars in savings to our names.

From afar, this just can’t be right. America is the wealthiest country in the entire world.

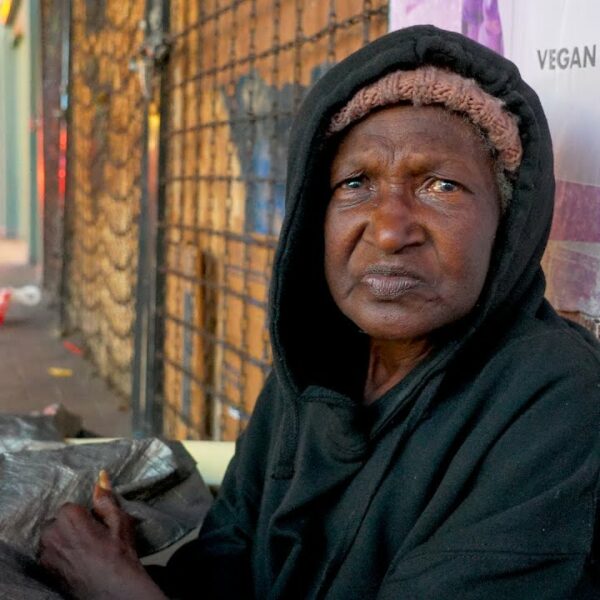

Television shows only the glamorous edges of the upper crust of society. The big screen is careful not to pull back the curtain too far, lest the audience catches a snapshot of the harrowing homelessness that exists mere miles from the Hollywood sign.

Rarely is homelessness ever reported. But when it is, the stories are carefully crafted to make the issue appear to result from poor choices. In reality, it is but a symptom of a weak system. As our founder, Mark Horvath, once explained:

“If homelessness were a punishment for bad choices, we’d all be homeless.”

The root of the problem is in the way we’ve structured the housing market. We favor vacant luxury lofts over affordable homes. Racist policies are infused into our lending practices. And we’ve created a system where the law is almost always on the side of the corporate landlord who holds all the chips.

As of March of this year, an astonishing 70% of millennials report not being able to afford to purchase a house.

For many people today, the idiosyncratically “American dream” has dwindled from sight. Renting, an option that is already much less affordable remains. Economists differ on price when it comes down to which is cheaper- buying or renting. This often becomes a matter of location. With housing prices constantly in flux, the price of homeownership is known to change.

What doesn’t change, however, is the price of monthly payments. In many locations, the average monthly mortgage payment is hundreds of dollars less than renting comparable housing.

As it stands, the average homeowner’s net worth is 40x higher than the average renter. Due to the unique conditions of homeownership, a higher down payment equates to a lower monthly payment. To this day, people of color are disproportionately squeezed out of the housing market and forced into renting homes at higher rates.

It Starts at Signing: How the Rental System is Designed to Keep People in Poverty

As we near the end of the pandemic, we enter into a rental system designed to perpetuate poverty. With rent being the only option left for most millennials, is it any wonder that rental rates have increased significantly higher than in the years leading up to the pandemic?

The median rent in the US is the highest it has been in two years, and experts do not foresee any downward trend. In stark contrast to this, wages continue to remain stagnant year after year, decade after decade. PEW Research reports that “rent increases outpaced income growth since 2001.”

In other words, this dire situation is 20 years in the making with no real end in sight.

The result of all this is rent burden, a situation where tenants are spending more than 30% of all household income on rent. This condition applies to more than half of all American renters.

Corporate landlords recognize this trend and have now begun making income requirements a condition for leasing at signing. This new tactic is just another way to make higher income the prerequisite for affordable housing-or any housing at all.

This doesn’t make apartments more affordable for everyday residents. Instead, it makes affordable housing even less accessible than before.

If these startling trends continue into the 2021 economy, homelessness will undoubtedly increase as well.

We don’t need a new social services sector. We don’t need mandatory sweeps. The overwhelming issue that causes homelessness has nothing to do with drug addiction or mental health. The problem is a lack of affordable housing.