Allowing the expanded Child Tax Credit (CTC) to expire at the end of last year caused more than 3.7 million children to fall into poverty, according to research by Columbia University’s Center on Poverty and Social Policy.

Overall, the U.S. child poverty rate grew from 12.1 percent in December 2021 to more than 17 percent in January 2022.

The 4.9 percent total increase was primarily driven by Black and Latino children, which accounted for nearly two-thirds of the total increase in poverty.

While the CTC was just one pandemic-related relief program, the data shows how vital the funds were to many families across the country. Households are battling the rising cost of living, while child care and health care have become increasingly expensive. This comes as women, particularly mothers of color, still face increased economic insecurities wrought by the pandemic.

Child Poverty Rates Will Remain High Without Action

Sophie Collyer, a research analyst at the Center on Poverty and Social Policy (CPSP), said that she expects monthly child poverty rates to remain “persistently high” throughout the year if Congress does not reinstate the program.

Lawmakers initially expanded the CTC program when they passed the American Rescue Plan Act in March 2021. The expansion increased the tax credit from $2,000 per child to $3,000 for those under the age of 17 and $3,600 for those under the age of six. It also made the program fully refundable, meaning it guaranteed full benefits for every enrollee. Half of the total refund was also made available in advanced monthly payments of up to $300 per child.

On its own, the CTC kept more than three million children from reaching poverty the month after implementation. By the end of 2021, the program had reduced childhood poverty by more than 30 percent, according to CPSP research.

Collyer adds that the number of children in poverty could moderate slightly during tax season because many families are still due to receive their full six-month benefit. However, this progress could be short-lived without “further policy interventions, or strong improvements in labor market outcomes,” she said.

CTC Helped Pay for Child Care

One benefit the expanded CTC provided for many households was it helped them pay for child care, a factor that the Federal Reserve Bank of St. Louis describes as “critical” to female workforce participation.

According to the latest unemployment data from the Bureau of Labor Statistics, more than 466,000 women left the nationwide workforce between December and January. This indicates that many women are still choosing not to work to help save money on certain expenses, and child care seems to be the primary cost many households are avoiding.

The St. Louis Fed has found that child care costs now make up an estimated 14 percent of median household income or about $9,000 per year. Families who avoid the cost risk paying a double price, negatively impacting future earnings. Stay-at-home parents may find it challenging to build the job skills necessary to re-enter the workforce, hindering future job prospects.

“Daycare closures and reduced operating hours, and virtual schooling continue in many areas, while mandatory quarantine periods and test-to-return policies affect the work schedules of parents whose children are exposed to the virus in their classrooms,” said Ana Hernandez Kent, a senior researcher at the St. Louis Fed’s Institute for Economic Equity. “Additionally, inflationary pressures may challenge families’ ability to pay for child care because they must devote more dollars to other expenses.”

Sam Evans, a community development advisor at the St. Louis Fed, said that increasing access to affordable child care promotes racial equity. Black and Latino mothers are more likely than their White and Asian counterparts to cite the high cost of child care as the reason why they aren’t looking for work.

Addressing Child Care Disparities Can Reduce Future Homelessness

This issue doesn’t just impact the parents, Evans added. She cited research from the Minneapolis branch of the Federal Reserve that children who attend high-quality child care facilities often see benefits into adulthood such as improved education and wage outcomes and better overall health. These outcomes can also help reduce the risk that an individual will experience homelessness in life.

“Workers, as well as the overall economy, could benefit from a more equitable and sustained approach to addressing long-term child care challenges, many that existed prior to the pandemic,” Evans said.

How You Can Help

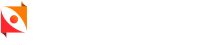

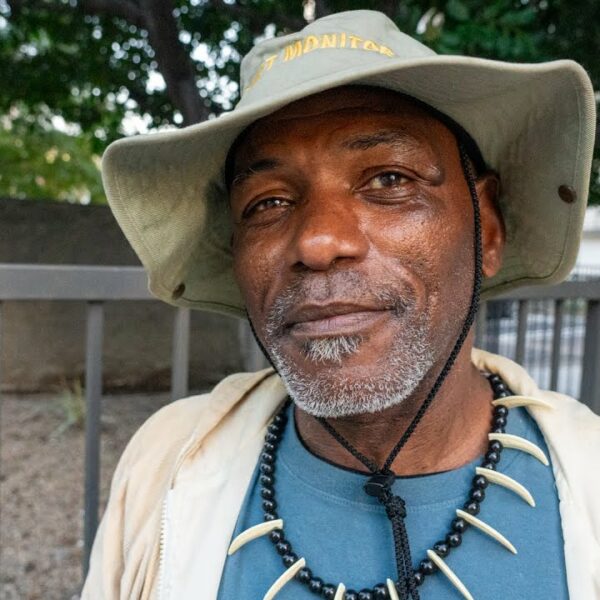

Now is not the time to be silent about homelessness. While Congress let the expanded Child Tax Credit expire, there are still plenty of ways to help our unhoused neighbors.

That’s why we need you to contact your representatives. Tell them that you support keeping many of the pandemic relief programs in place. These programs have proven to reduce the risk of people experiencing homelessness and have improved poverty outcomes across the country. We need to make these investments now more than ever.