Why America’s Elderly Are Falling Through the Cracks

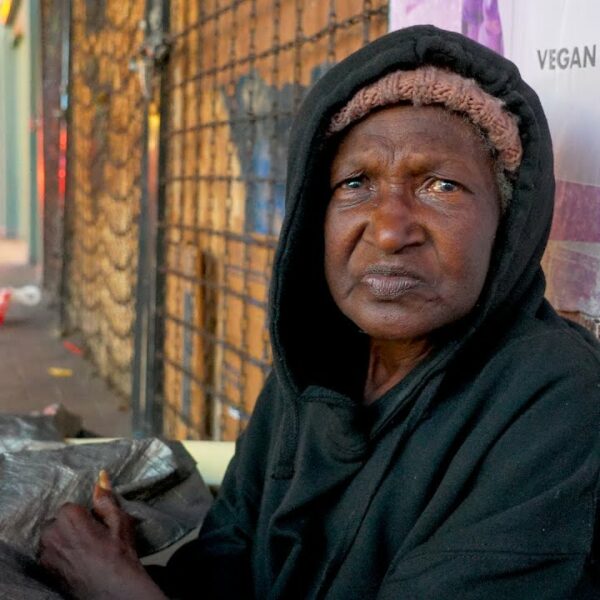

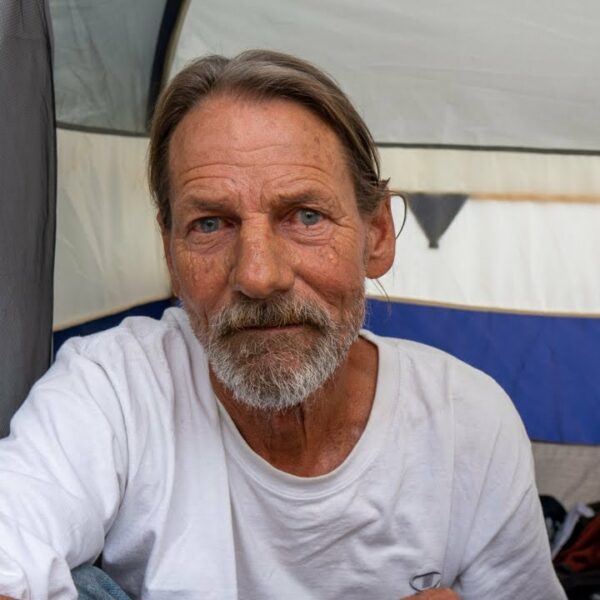

Most adults hope that by the time they reach age 65, they’ll be able to comfortably retire. They may dream of finally having time to pursue their interests or take up new hobbies. There’s a whole other segment of the elderly population, however, that isn’t living the life they dreamed of. These individuals worry about how they will eat, where they will sleep, and what will happen if they get sick.

The number of elderly individuals experiencing homelessness is rising. In the Annual Homeless Assessment Report, released by HUD, the number of elderly individuals experiencing sheltered homelessness nearly doubled from 4.1 percent in 2007 to 8 percent in 2017. It’s not slowing down, either. This population is expected to triple over the next decade.

A new study out of UCSF showed that almost half of all elderly homeless people became homeless after age 50. These statistics tells us that whatever the problem is, it’s related to age. The question we need to ask ourselves is, why are the elderly falling through the cracks?

Lack of Retirement Funds and Savings

The people who are most at-risk for falling into homelessness at an older age are poor middle-aged individuals. They’re the ones making ends meet through low-wage jobs, but not making quite enough to put money away for retirement.

Their jobs also aren’t as likely to offer adequate retirement benefits. Only 23% of workers have pension plans, and only 15% of those are in the private sector. Low-paying jobs are the least likely to offer pensions, and even when employers offer programs like a 401(k), they’re not utilized as much by workers with low incomes.

People in general, homeless or not, are less confident about whether they’ll have the money they need to get through 20-40 years of retirement. A big part of this is debt. Around 77% of families with heads of households between ages 55-64 are in debt. This is a big problem when finances are already tight. More money owed means less to put into savings, along with the frightening possibility of foreclosure or wage garnishment.

As a result, more people are expecting to have to work post-retirement. Many don’t even have a definite age at which they’re aiming to retire. There simply is no end or relief in sight.

Injuries, Disabilities, and Illnesses

Americans may be working longer, but at some point they’ll no longer be able to perform manual labor. Standing for long periods of time becomes dangerous or even impossible due to health concerns. Disabilities like arthritic and illnesses like chronic pain contribute to people over age 50 not being able to work their former jobs.

To compound the problem, elderly homeless individuals typically have medical needs that those with housing 20 years their senior have. This makes it more difficult for seniors to climb out of homelessness once they enter it.

Most resources and programs are equipped to tackle the major problems facing the general homeless or at-risk population, like mental illness, substance abuse, and housing assistance. Not many offer solutions specifically for the aging, the greatest of which may be physical health.

Government programs are out of date and designed for younger generations. They do not address the entirely different set of factors that place the elderly at risk.

Higher Costs of Living

The current minimum wage is $7.25 per hour. According to the Economic Policy Institute, minimum wage today would need to be $19 per hour to keep up with necessities like food and housing. Nearly everything costs more than it did for baby boomers when they were younger. Gas prices, healthcare costs, and automobile insurance rates are all going up.

While inflation rises higher and higher each year, wage stagnation ensures Americans have a harder time keeping up. When taking all the increased costs into account, wages haven’t increased significantly. Nearly 40 years ago in 1980, minimum wage was $3.10. It’s just barely doubled, although the average price of a house has quadrupled since that same year. The median rent has doubled, according to a study from Apartment List.

Even the elderly who do have a pension or retirement account are still living on a fixed income. It doesn’t allow for rapidly rising inflation, much less exorbitant housing costs. A notice regarding a hike in rent or an unexpectedly high medical bill can mean financial ruin and, unfortunately, a step closer to homelessness.

Lack of a Safety Net

Many people turn to close family when they encounter financial hardships. For example, it’s common for young adults to move in with their parents during the unstable time immediately after college. For several reasons, older adults don’t always have the same safety net.

Elderly homelessness can begin with a divorce, if one’s spouse was the breadwinner and the other unskilled or uneducated. Other times it may be the eldest in a multigenerational household passing away, leaving the younger generations to fend for themselves.

Even if a struggling aging person does have family who can support them—a son or daughter they can move in with—it can be hard to accept the help. This is especially true if there’s a long-standing problem, like a disability, keeping them from getting back on their feet anytime soon.

Government programs that should provide a safety net, like Social Supplementary Income (SSI), don’t go into effect until an individual reaches age 62. This leaves out those between 50 and 62, who often have quite a few health problems of their own. This is especially problematic if they are low-income, as they’re less likely to receive preventative healthcare.

In addition, the average lifespan of a homeless person living on the street is 65. The tragic implication of this is that many will not even live to reap the benefits of SSI.

Our Response to Homelessness Needs to Adapt

The face of homelessness is changing. We need to take into consideration the unique challenges the elderly bring to the table. Resources and programs simply cannot be allowed to stagnate. We need:

- more affordable, permanent housing for seniors equipped with proper medical care

- to engage the struggling baby boomers and seniors by informing them about the resources that are available

- and finally, we need to empower the elderly by securing legal help when they face issues like foreclosure or financial exploitation. Legal aid is also helpful in securing safety nets for aging individuals, like getting them enrolled in social security when it’s time.

No one wants to spend their golden years on the streets. Remember, then, to do your part by keeping yourself aware of the problems facing the homeless and advocating for change.