Housing affordability has become a primary concern in the rental market as the average rents in the 50 largest cities continue to skyrocket.

Realtor.com reported that the average rent increased by more than 19 percent, up to $1,807 in March, compared to rents from March 2020. This spike follows a notable dip during the pandemic because of COVID-related policies that prevented evictions and provided renters and landlords with much-needed financial assistance.

Danielle Hale, Realtor.com’s chief economist, said the latest report also contains signs that the rent increases may be slowing as the economy continues to recover. However, she added that the continued mismatch of housing supply and demand coupled with the country’s historically low rental vacancy rate could keep rents elevated into 2023.

“We expect cooling to continue over time, but the jury is still out on whether rent growth will hit single-digits by the end of 2022,” Hale said.

Housing affordability became increasingly challenging for many households after the pandemic began in 2020. Not only did COVID-19 cause many people to lose their jobs, but it also sharply increased the demand for non-congregate housing.

Realtor.com’s report found the demand for isolated shelter was one reason why one-bedroom and two-bedroom apartments saw the fastest rent increases between March 2020 and March 2022. Two-bedroom units saw their average rent climb by more than 21 percent over the two years, while one-bedroom rents climbed by more than 17 percent.

But non-congregate shelter seems to be just the tip of the iceberg these days as households continue to face the highest inflation rate recorded over the last four decades.

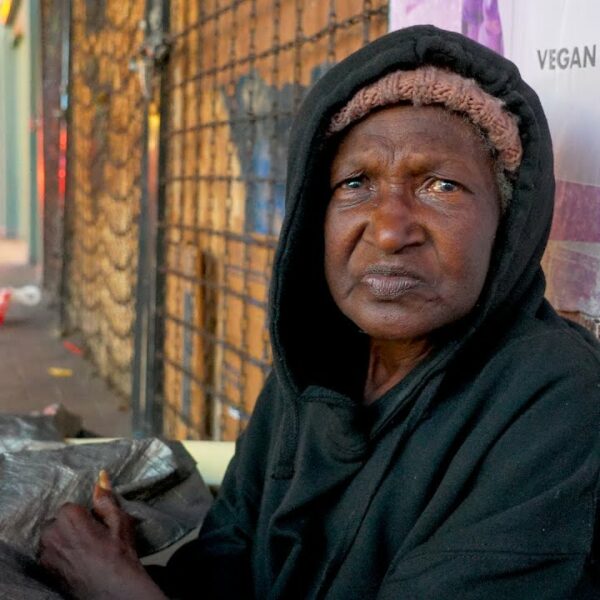

Household wages are also struggling to keep pace with inflation, increasing the risk of experiencing homelessness for many low-income households.

According to the latest consumer price data from the Bureau of Labor Statistics, consumer prices were up more than 8.3 percent year-over-year last month. That is slightly below the 8.5 percent mark recorded in March.

Meanwhile, compensation for employees increased by just 4.5 percent over the same period, meaning that many households have seen their income drop by four percent over the last 12 months.

“It’s unlikely that we’ll see enough income growth to keep rents under 30% of monthly paychecks, especially with higher inflation and everyday costs,” Hale said. “Still, there is a silver lining for renters, as rents won’t be able to sustain an accelerated pace if incomes can’t keep up.”

Renters in relatively affordable markets outside of urban cores feel the squeeze of increasing rents much more than those who live in high-cost markets. For example, rents in Richmond, Virginia, have increased by 30 percent year-over-year up to $1,430. Renters in Phoenix, Arizona, are singing a similar tune after rents increased by 29 percent since March 2021, up to nearly $1,900 per month.

On the other hand, many tech-heavy markets like San Francisco and San Jose, California, have seen their rents decline. However, their average rents are still much higher than the national average. The report said that median rents for studios and one-bedroom apartments in San Francisco declined by 13 percent year-over-year, while rents in San Jose declined by just three percent.

One reason for this decline is that the pandemic shifted how many Americans earn a living by increasing remote work opportunities.

Realtor.com’s report found that this is one reason why rents increased at a feverish pace in rural areas compared to downtowns.

Meanwhile, one issue compounding the struggles for low-income households is that the U.S. is currently suffering through one of the lowest rental vacancy rates in the last four decades. The rental vacancy rate represents the percentage of available rental units in the housing market.

According to data from the Census Bureau, the U.S. rental vacancy rate stood at 5.8 percent during the first three months of the year. That is the lowest figure recorded during any quarter since 1985. Low vacancy rates for households on the lowest end of the income spectrum often mean it will be difficult to find new homes if rents become unaffordable.

“For some, such as Gen Zers striking out on their own, even small rental savings could make a large difference,” George Ratiu, manager for Realtor.com’s economic research division, said.

How You Can Help

The pandemic proved that we need to rethink housing in the U.S. It also showed that providing additional support and protections for renters is a clear-cut way to reduce future increases in homelessness.

That’s why we need you to contact your officials and representatives. Tell them you support keeping many of the pandemic-related aid programs in place for future use. They have proven effective at keeping people housed, which is the first step to ending homelessness.