Experts say that the rising number of cost-burdened renters in the U.S. highlights the need for new ways to fund affordable housing development.

During the pandemic, the share of renters spending more than 30 percent of their income on housing expenses jumped to 46 percent, according to Harvard’s Joint Center for Housing Studies (JCHS) data. That represents an increase of 2.6 percent year-over-year at a time when job losses mounted, and rents continued to climb skyward.

Now that the U.S. is hoping to move past the pandemic, cities are working to increase their supplies of affordable housing. However, financing barriers could prevent these entities from producing the right kinds of housing for their most vulnerable populations.

“Further income supports and rental assistance will be needed to help renters cope with increasingly unaffordable housing, especially given the record-high rent growth and tight market conditions over the last year,” said Whitney Airgood-Obrycki, a research analyst at JCHS.

The need for more affordable housing options for low-and-middle income renters became glaringly apparent during the pandemic.

JCHS data shows more than 80 percent of households earning $30,000 or less are now cost-burdened, an increase of more than five percent over the last 12 months.

The share of cost-burdened middle-income renters, which are defined as those earning between $30,000 and $45,000 annually, jumped to nearly 58% during the pandemic, a rise of nearly 10 percent.

In response, several states passed laws that gave local housing authorities more leverage to develop affordable housing. For instance, California lawmakers passed a law that effectively ended single-family zoning in the state. Colorado lawmakers passed a bill that allows the state housing authority to require affordable housing through land use codes.

While these efforts are laudable, some experts say states could face financing hurdles as they seek to develop more affordable units.

One affordable housing type that could be difficult to build is residential service programs, according to research by Mel Miller, the 2021 Gramlich Fellow at JCHS.

Residential service programs are housing developments that also include education, healthcare, eviction prevention, long-term supportive housing, and workforce development services. However, these programs often rely on a patchwork of state, federal, and nonprofit funding. This makes it difficult for local authorities to scale residential service programs to meet the demand in their housing markets.

“If public, nonprofit, and other funders could increase funding availability and consistency, they could redefine housing to extend beyond shelter and include services that promote the physical, emotional, and financial health of residents,” Miller wrote.

Another form of affordable housing that experts say needs better financing options is accessory dwelling units (ADU), also known as “granny flats.” ADUs are self-contained living spaces separate from the home and property they’re attached to.

Although the housing type has gained in popularity in recent years, Richard Green, the director of the USC Lusk Center for Real Estate, argued that ADUs can both increase the number of affordable units and reduce the wealth gap between white and non-white households.

“ADUs, often incorporated inside existing homes or on existing parcels, are not given the same community scrutiny as larger apartment buildings,” Green wrote. “[They] are often politically insulated from neighbors’ objections that otherwise successfully block larger scale housing projects. When rented, ADUs often are leased at rents that are affordable to households earning below the area median income.”

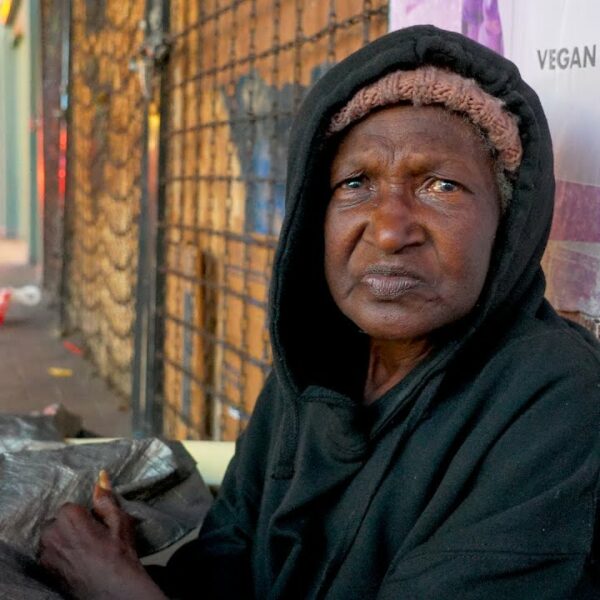

The ability of ADUs to reach low-income renters could help stave off significant increases in the country’s total homeless population at a time when many renters are struggling to afford rent. According to data from Realtor.com, the country’s average rent for a two-bedroom apartment climbed above $1,800 in May, a 15.5 percent increase year-over-year.

Meanwhile, a Government Accountability Office report from 2020 found that a $100 increase in an area’s rent correlated with a nine percent increase in local homelessness.

How You Can Help

The pandemic proved that we need to rethink housing. It also showed that providing additional support and protections for renters is a clear-cut way to reduce future increases in homelessness. It also showed that the country needs more affordable housing options.

That’s why we need you to contact your officials and representatives. Tell them you support keeping many of the pandemic-related aid programs in place for future use. They have proven effective at keeping people housed, which is the first step to ending homelessness.