At a time when many Americans need the opposite to happen, rental rates are exploding before our very eyes. Data shows that rent increases far outpace wages and inflation rates nationwide, climbing at an astonishing rate of 9.1% per year. This May, that number is even higher.

Realtor.com, a leading website owned and operated by the National Association of Realtors, has a stellar reputation for statistical accuracy. At the turn of summer, just as the end of the road for eviction moratoriums became visible around the bend, this website released some astounding stats on rental rates.

According to the site, May of 2021 marks the highest rental rates experts have seen in the past two years. In reality, these numbers are even more notable. To quote from the site directly, they go on to say that:

“Rents across the country reached new highs in June. In 44 of the 50 largest metro areas, rents reached their highest levels on record and are growing faster than ever.”

You read that last part right: “faster than ever,” not just faster than in the past two years. This is major news. Have you heard it before today?

Higher Rents and Lower Wages: What Kind of Broken Fairy Tale are We being Sold?

This news has been delivered to America in a beautifully wrapped package. The message is laden with soft, flattering words, suggesting this is a good thing. Higher rents mean a bustling economy, or so we’re told.

We can rest assured things are going well because landlords are piling pretty pennies away, and all is right with the world. Economists render for us a virtual jigsaw puzzle that only serves to complicate the matter further.

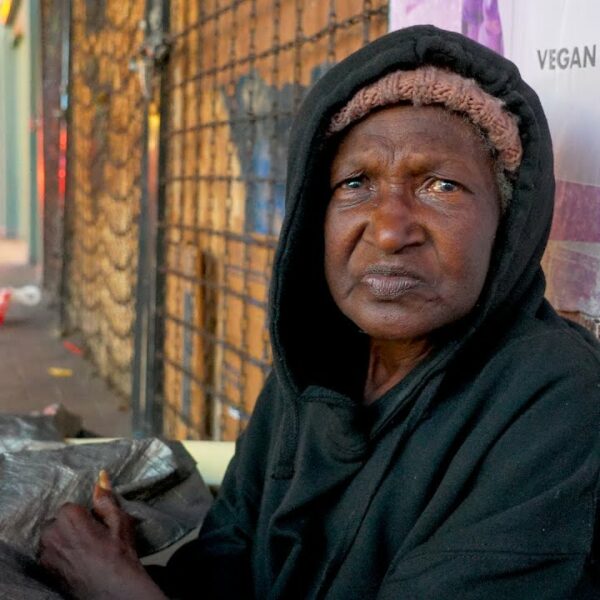

Academia has gone so far as to push theoretical studies claiming lower rents are bad for the economy. In a world of fair wages, perhaps that could be true. But the harsh reality you see outside your window is far from theory.

In an Invisible People independent research study, we learned that 73% of Americans believe that homelessness increased last year in their community. They are correct in this assessment.

Not only has homelessness increased across the nation in the past year, but it has also increased every year consecutively for half a decade.

This is a crisis. We’re in a jam.

1 in 30 American children has been horrifically rendered homeless.

Eight million new American workers have been quietly forced into utter poverty to make space for eight new trillionaires.

Somewhere between 6 and 11 million renters are at risk of eviction.

We are knee-deep in a homeless crisis, a housing crisis, and a health crisis. We scour the globe in search of answers. And now, on the heels of the pandemic, once every protection has been abandoned, and every stimulus payment has been cashed, we get one, and it’s this: The highest rental rates we’ve ever seen and wages that haven’t budged in decades.

Maybe we need to reexamine the definition of “good for the economy.” Is it always in direct conflict with the public interest?

How Bad are these New Rental Rates?

As of June 2021, the median rental rate nationally was $1,575 per month. This equates to an increase of about $118 per month compared to last year’s rental rates.

According to the US Department of Labor, the federal, nationally recognized minimum wage is just $7.25 per hour. Let’s start there.

At a $7.25 per hour rate, with a tax rate of approximately 12%, a minimum wage worker can expect to bring home about $1,021 per month working a 40-hour week. If they spent every penny of that on rent, it still wouldn’t suffice.

So, let’s double up and say this worker is highly ambitious, takes on a second job, and works virtually around the clock for 80 hours every week. Now, they have just over two grand, which means that they have about $467 left for the month after paying their rent. They must spend this money on food, phone bills, utilities, internet, clothing, work uniforms, transportation, toiletries, prescriptions, the list goes on and on.

Some might say that if they worked 12 hours per day, seven days a week, and lived on only the bare essentials, they could actually have a place to live.

But, wait a minute. They wouldn’t qualify for the apartment.

Today, most landlords require their tenants make 3x the rent to be approved. This means that in order to afford a median rental rate, an American worker would have to earn $4,725. In other words, a minimum wage worker would have to work four full-time jobs in order to afford to live in a home basically anywhere in the nation. That’s a 160-hour workweek. Not too shabby, considering there are 168 hours in each week.

This leaves a minimum-wage worker with two options: be homeless or find a way to survive on eight hours of sleep per week. Both of these scenarios are likely to lead to hospitalization and eventually premature death.

Perhaps the above-listed scenario seems far-fetched to you. Maybe you consider yourself middle-class. You’re not too concerned with the minimum. Okay. What about average-earning workers?

In 2018, Business Insider reported that the average American worker makes about $44,720 per year. Having not adjusted for the millions of pandemic-related layoffs, how does this number measure up to the new rental prices? This equates to approximately $3,726 per month. When you divide that by 3, you see that the average American employee is still spending well over 30% of their salary on rent.

We call that rent burden in the social services sector – and it is literally crippling our working class.

A Lack of Affordable Housing is the Leading Cause of Homelessness

Please contact your representatives and express your concern over surging rental rates. The way to solve the ever-growing US homeless crisis is to making housing more affordable, not even less so.