Don’t Blame Fiscal Irresponsibility. Rental Rates Have Increased Almost Twice As Much As National Wages in the Past 2 Decades

“To be evicted in the height of a pandemic would be devastating for these families, and for the nation as a whole as it struggles to break the emotional and economic grip the virus has imposed for almost a year.”

~ Jim Parrot and Mark Zandi’s thoughts from “Averting an Eviction Crisis”

Recently, chief economist and nationally recognized provider of economic research Mark Zandi appeared in an NLIHC webinar to discuss eviction in the Coronavirus era. He presented many perspectives that are worth a deep dive and are available on his blog Moody’s Analytics.

One point he made during his webinar appearance was the fact that renters are statistically proven to be unable to save money when compared to homeowners. Let’s take a look at that data and see how it plays a role in creating homelessness, particularly now, when approximately 10 million renters are delinquent, and their accounts have been in the red for months.

The Data: Renters Have Much Fewer Savings to Fall Back on When Compared to Homeowners Because They are Unable to Save at a Competitive Rate

A 2020 analysis of renters showed a statistically significant discrepancy in savings. Most renters possess less than $5,000 in savings while most homeowners possess more than $5,000 in savings. These numbers suggest that the average renter is saving money at a rate of about $440 per year while the average homeowner is saving money at a rate of approximately $10,700 per year.

At first glance, these figures could be erroneously mistaken as a testament to the renter’s fiscal irresponsibility. In reality, however, homeownership in and of itself serves as a kind of “forced savings” that automatically boosts a homeowner’s net worth at a rate 40x higher than the average renter. This is partly because homeowners are building equity and renters are not. But that’s not the entire story.

Another major reason why renters struggle to save is the rate at which rents are rising, in general, and compared to national wages.

Over the past two decades, rental prices have doubled the pace of wages. So, while wages have increased by 31%, rental prices have gone up by 61%. Additionally, rental costs increase annually for each tenant, creating a cycle that forces renters to skip around from one property to the next because the building they could afford to live in back in 2019 is now completely unaffordable in 2021.

This was the financial climate for renters before the pandemic hit. Now, with mass unemployment affecting millions of US residents, the bulk of whom are renting their homes, statistics are even more dismal. For example, three out of four renters today lack the financial resources they had in the years before the pandemic.

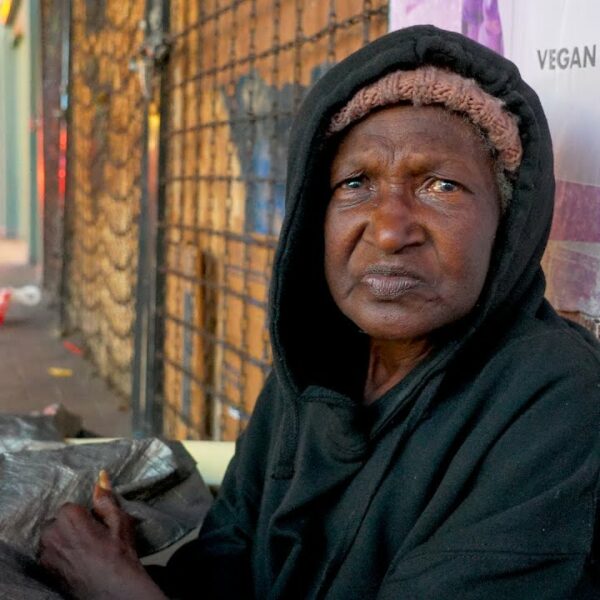

This means savings will likely decline even more. Because of this, economic experts anticipate a threefold rise in evictions once the latest eviction moratorium expires. If that happens, homelessness will undoubtedly increase, taxes will go up, and property values in low-income neighborhoods will plummet.

If You Want to Prevent Homelessness and Help Mom and Pop Landlords, Support Rent Relief

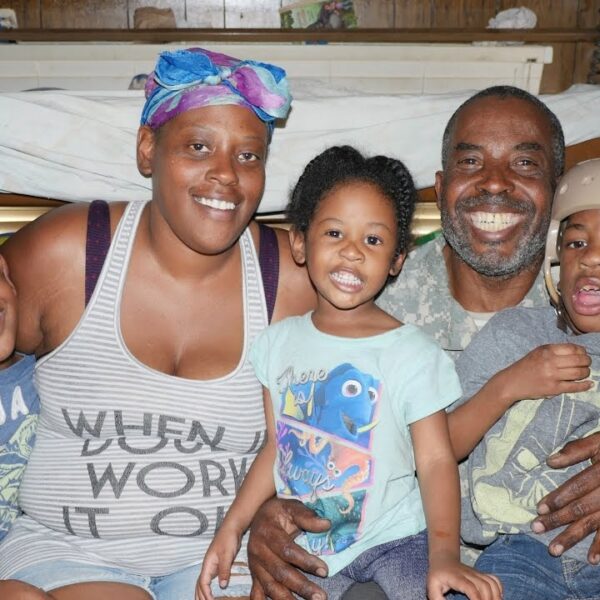

Rarely do we find a one-size-fits-all solution for homeless prevention. However, in the tumultuous climate of a post-COVID world, rent relief stands out as a beacon of hope. It is a solution that helps both tenants and landlords to maintain their quality of life.

But rent relief can only work if it is distributed in a timely, efficient manner. Policymakers must emphasize swift action on behalf of state governments in getting this funding to the people who need it most in the fastest way possible. Instead, many governments are moving at a painfully slow pace.

As an example, the city of Wilmington, Delaware anticipated about $200 million of the $25 billion allocated for rent relief through the Emergency Rental Assistance Program. However, officials refused to even accept applications for rent relief between December 31st through the end of January. That’s an entire month lost. And who knows how many tenants paid the price for this delay.

Delays in Payment Work in Favor of Landlords and Against Renters

There is much gravity in this situation. Every moment wasted not distributing rent relief funding is another opportunity for a landlord to:

- Evict

- Add late fees

- Add court fees

- Harass tenants

- Resort to shady illegal tactics such as threatening, shutting off utilities, and locking tenants out of their homes

Meanwhile, the tenant, who is patiently waiting for the government to catch up on:

- Unemployment payments

- Rent relief distribution

- Food and financial assistance

is penalized for their patience by being forced into unnecessary homelessness. Once a renter is made homeless, their ability to save dwindles even more. Their net worth falls further. The cycle will continue until someone puts an end to it.

Talk to your representatives about putting more protections in place for renters who have been made vulnerable to homelessness because the system failed them during the catastrophe of COVID-19.