House Prices Soar Hundreds of Thousands of Dollars While Wages Remain Stagnant for Four Decades. Make it Make Cents.

In the late ’80s and early ‘90s, the expression, “If I had a million dollars…,” rose in popularity. Those old enough to remember the context probably recall conversations related to the subject. Someone would say, “If I had a million dollars, I would buy….” Here, you could insert the latest luxury vehicle, a sprawling mansion, an oceanfront dream house, an island, etc.

Looking back, it’s easy to see that there was undoubtedly an inflated sentiment surrounding just how far a million dollars could take you in life.

But hey, what did we know? In 1999, the average individual income was approximately $32,127 annually, an amount that, when adjusted for inflation, is the equivalent to approximately $50k a year.

According to The Economic Policy Institute, today, the median wage stands firm at approximately $19.33 per hour. When converted to a yearly wage, that rate equates to about $40,000 per year for a full-time worker pulling a 12-month calendar gig.

This has led many to argue that today’s wage is actually lower than it was two decades ago. This is certainly true for minimum wage workers who are making 21% less than they were 12 years ago, but a bit more complex the higher up the income ladder one might go.

It is definitely accurate to say that wage growth is slow for the vast majority of American workers. Substantial income increases are reserved mostly for top earners while low, and middle-income workers bear the brunt end of economic decline.

This is not a matter of hard work or education either. Studies show that the bottom 50% of college grads are taking home a smaller paycheck now than they were 20 years ago.

Through further scrutiny, it becomes clear that dynastic wealth taking place in the upper echelons of society is widening the class gap and creating unparalleled income inequality, a devastating trend no fancy degree can rectify.

Pew Research estimates that for the vast majority of United States workers, “real wages have barely budged” in 40 years. What’s more, even paychecks that look bigger sport significantly less purchasing power in the modern market. Even so…

Yahoo Reports That in a Record-Breaking Tally, the U.S. Median Home Price Surpassed $400,000 in 2021

If you ever needed further proof that there is, indeed, a housing crisis, or that the lack of affordable housing is, in fact, the leading cause of homelessness in America, you need only glance at the figure above once more. On October 21, 2021, Yahoo News reported that the median home price had surpassed a historic milestone, reaching rates above $400,000 for the very first time.

When the information was released, Goldman Sachs economist Jan Hatzius projected rates would continue to surge astronomically through 2022. That calculation was correct.

The Average Sale Price for an American Home in 2022 is $507,800

Figures presented by Federal Reserve Economic Data and published by World Population Review reflect a gasp-inducing price tag placed on the average American home, which currently sells for a little over half a million dollars.

To be fair, the median price of houses throughout the 12-month calendar year was $428,700, still dangerously close to half a million. It is of note, too, that because the supply doesn’t meet the demand, about half of all homebuyers are paying a price well above what is listed online. This could explain the gaping discrepancy between the median home price and the average home sale. Other factors also fuel the dismal situation.

Worse still, the report goes on to explain that the average American worker can only afford a home worth half that price, or about $250,000. If Jan Hatzius is correct again, this over-inflation of the American wallet at the price of a thriving middle-class is unlikely to crash or even stall. The reason for this is easy enough to explain.

Back in 2008, when the housing bubble popped due to several banks and mortgage companies taking advantage of the country’s vast and growing class of working poor people, rather than sending the white-collar criminals to jail, the American government boosted them with a trillion-dollar bailout.

Not only did the bailout manage to squeeze and pinch what little was left of community banks, but it also set a precedent, the idea that certain corporations were simply too big to fail.

In the words of Matt Taibbi of Rolling Stone:

“Those banks were rewarded with bailouts and state-aided mergers that allowed executives to quickly return to previous compensation levels, and left them more dominant than ever.”

He went on to conclude that as a result of this deal:

“Banks prospered and were made whole; regular people went into foreclosure by the millions and saw their credit ratings ruined.”

What we are seeing today is an aftereffect of those and other similar decisions.

The Lack of Affordable Housing is What’s Making the Housing Prices Surge and Causing Widespread Homelessness At the Same Time

The leading cause of this surge in median home prices and average home sales also happens to be the leading cause of homelessness. It is the lack of affordable housing.

This is not a coincidence but a design.

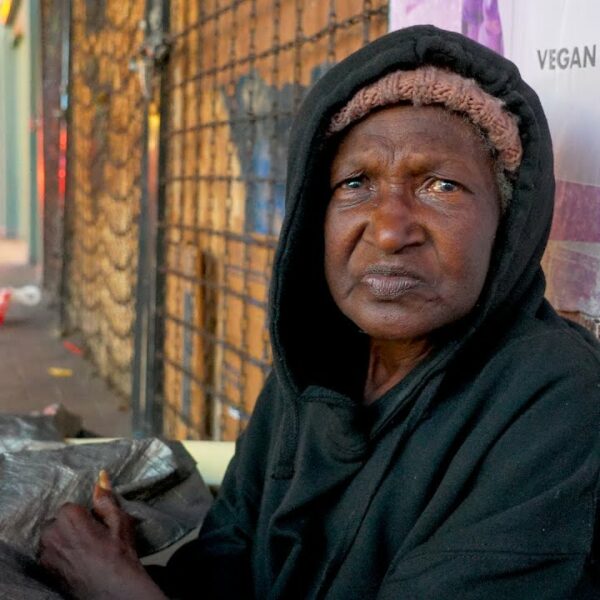

If you have not already purchased a home and you earn an average or low income in America, you will almost certainly be priced right out of homeownership. You may even be forced onto the streets or the living room sofas of friends and family members as homeless shelters overflow and rental prices rocket to the sky.

This crisis is touching everyone. With a shortage of more than 7 million affordable homes on record, things can only get worse if we do not take action.

Contact Your Legislators

It’s no coincidence that wages went into stagnation mode in the same decade, housing prices started to soar.

It’s no coincidence that the same crisis making millions homeless is also making millionaires rich.

Amid economic decline and unfathomable corporate greed, perhaps the worse thing we can do is nothing at all.

Contact your policymakers and ask them to prioritize the construction of affordable homes immediately before the opportunity to live in one fades right into the background of American life.