“The costs of buying or renting a home have risen exponentially, pricing many military families out of the markets they’re ordered to move to.”

Blue Star Families on how the housing crisis is hitting US soldiers

Lack of affordable housing has been slowly seeping into our national infrastructure for some time. In 2016, it was determined that one in four housing markets had experienced historic highs in rental rates and mortgage prices. In the aftermath of the pandemic, that number has only increased.

Poverty rates are soaring as well. The World Bank projects that as many as 150 million people will be living in abject poverty across the globe in the foreseeable future. In the United States alone, conditions exacerbated by COVID-19 have quietly thrust approximately 8 million new American citizens into the shadows of financial devastation.

But what if those numbers don’t apply to you? Perhaps you managed to hold onto your job and surf the uncertain economic climate with less difficulty than others. That doesn’t mean the housing crisis won’t affect you.

What is Trickle Down Economics, and How Does this Concept Relate to the Current Crisis of Housing?

Perhaps you’ve heard of trickle-down economics- the theory that in times of financial hardship, money should be distributed to top-earning organizations (think banks, mega-stores, top-tier institutions and their CEO’s, etc.) with the hope that they will distribute it proportionately to their employees, causing the funding to trickle down like soft rain.

In reality, this seldom happens. What often follows in situations where trickle-down economics are applied is that the poor are simply left out in the rain. At the same time, wealthy corporate executives pocket the lion’s share of bailout money. For this reason, this type of political policy is met with much-deserved criticism from the general public.

What we are finding out now is that the opposite of this agenda is not so great either. Under the current circumstances and perhaps for the first time in many years, we are witnessing a trickle-up effect within the housing market. It is one where upper-middle-class and active military families are also being priced out of housing.

If we no longer have “affordable housing” for families who meet this description, how could we ever expect people with even lower incomes to compete? In short, the answer is we can’t.

The Plight of Active Military Families in Securing Housing

It’s a well-known fact that military families are forced to move around. For years, decades, centuries even, that aspect of military life has been an adjustment, but not an impossibility. However, many members of today’s militia report an entirely different struggle when it comes to taking up new stations and moving across the country. Some of the many struggles they face in the 2020-2021 housing market are as follows:

- Exorbitantly high prices for rentals and mortgages in our post-pandemic housing market

- Being forced to move on short notice

- Not finding any affordable homes in their newly assigned location

- Spending weeks or months on waiting lists

- Out-of-pocket costs

- Breaking leases at their own expense

- Spending months in hotels waiting for housing to open up

- Separation from children, spouse, and other family members

- Unclean or unsafe conditions in new rentals

When asked about accessing housing during mandatory military relocations in the 2020 and 2021 calendar years, military families described a myriad of tribulations they had not previously faced. The result was unstable, unaffordable, and in some cases, utterly inaccessible housing conditions.

The phenomenon was so widespread, in fact, that approximately 77% of military families surveyed this past year reported paying over $200 in out-of-pocket housing expenses each month. While moving around has always been considered part and parcel of military service, nobody expects those costs to be taken directly out of their own pockets. Yet, this is the new American landscape, and the forecast calls for even more of a decline.

A Broader Implication Exists for Individuals on the Brink of or Already Experiencing Homelessness

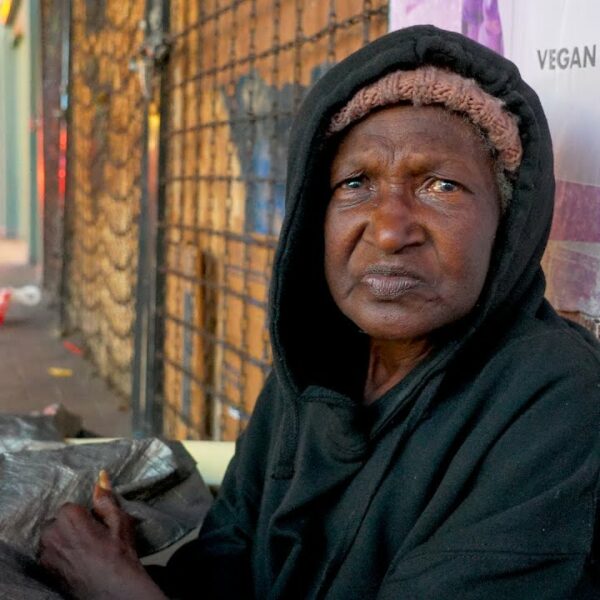

If this is the way we are treating active members of our military, imagine the struggle of a non-military family facing eviction or already enduring the horrors of homelessness. The age-old story has found for itself a new revolving door. Behind it sits a sidewalk filled with houses nobody can afford, late fees and unexpected out-of-pocket costs, legal red tape, and waitlists so long that help feels a million miles away.

To some extent, this has always been so, but therein lies a new distinction.

Bureaucratic red tape has relegated certain sections of our nation as off-limits for low-income earning individuals for many years. Now that tape has been stretched even further, inching upper-income earners and active military families out of the affordable housing market as well.

How long before every inch of our nation is reserved for the top 1% of earners? How long before homeownership and the privacy that comes with it go from an American dream to an unobtainable luxury? Are we already there?