Throughout the global pandemic known as COVID-19, national media outlets zeroed in on vulnerable renters. Due to the public health crisis and subsequent shutdowns that followed as a response to that crisis, many newly impoverished Americans stood on the brink of eviction, protected by temporary orders that delayed landlords from taking immediate action in most cases.

Studies show that these bans on eviction, however temporary, did save lives and prevent homelessness. As protections fell, media sentiment shifted, revealing a bird’s eye view of an encroaching new crisis of renters on the streets.

Yahoo! Finance reported a “sharp, rapid increase in evictions” shortly after the nationwide moratorium ended in late August. As housing instability surges nationwide, many victims of pandemic-related eviction will find themselves tossed onto the streets through a judicial system that was invented specifically to work against them. For these unfortunate renters, homelessness is a swift pendulum swinging in their direction.

As rental assistance trickles along, the renters mentioned above could find a saving grace in Emergency Rental Assistance (ERA). However, there currently exists a subset of renters who might not be so lucky. Their plight is underreported but equally unsettling.

These are the renters who are not included in the number of people deemed vulnerable to eviction. These are the renters who managed to stay afloat, avoiding missed payments and late fees. Yet and still, they too could wind up homeless through a slower, more agonizing process that would be difficult to track and report.

Studies Suggest that Many Renters Resorted to Unsustainable Means to Keep their Bills Paid

In an eye-opening new paper published by the National Low Income Housing Coalition entitled “The Road Ahead for Low-Income Renters,” the plight of the caught-up renter is detailed. Their circumstance looks good on paper. Their rent is not technically behind. They appear to have avoided eviction altogether.

However, closer scrutiny reveals this is a farce. Many of these households have managed to stay afloat by using payment methods that will likely prove destructive in the future. These include but are not limited to:

- Credit cards

- Payday loans

- Borrowing from friends and family

- Funneling their entire savings

- Selling assets

- Prioritizing rent over other basic necessities

These renters could be in an even worse predicament because, although their finances are strained to the point of breaking, they are not technically behind on their rent. This disqualifies them from obtaining Emergency Rental Assistance. It also shuts them out of the statistical databases, creating a subset of at-risk renters virtually invisible and void of aid.

How Homelessness Can Happen if Unsustainable Means Played a Pivotal Part in Rental Payments

It’s important to note that this is the group of renters who went to great lengths to make their payments. In the end, homelessness can still catch up to them in a heartbreaking, darned if you don’t, darned if you do scenario.

Let us take the first two examples of using credit cards or predatory loans to pay rent during hard times.

As time wears on and wages continue to dwindle, these unsustainable means give way to inescapable debt. This is particularly true of payday loans that routinely exhibit interest rates 10 to 20x higher than the norm.

American Progress reports that the typical $375 payday loan comes with an interest price tag of about $520. Lenders dig a grave-like ditch for poor people by charging even more in interest than the borrowed amount. Approximately 1 in 4 payday loan borrowers will have their bank accounts closed in the following year, and 1 in five will see their vehicles repossessed. Imagine trying to keep up with the rent once you have no bank account and no car.

On the flip side, individuals who borrowed from family or friends or sold off worldly possessions to avoid rental fees are also left vulnerable. They have since drained their savings, lost their vehicles, or worse – they might now have a strained relationship with friends or family members. Should they then lose housing as they scramble to make good with their returns, they will have lost the very safety nets they created for themselves.

All can be gone in the blink of an eye. This is a foundation for disaster.

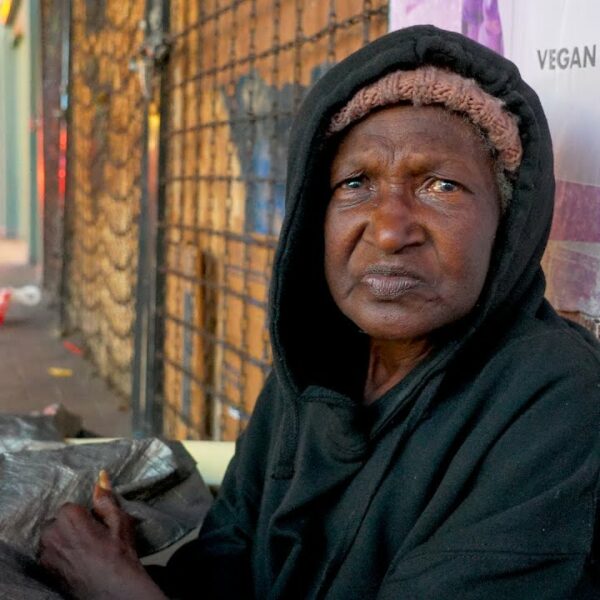

Stand Up for These Uncounted Renters

Debt, loss, and lack of support are all intricate paths into homelessness. Unlike immediate eviction due to a lack of timely payments, these other pathways are more difficult to track. This is why we must advocate for these renters whose plights are not included in the databases. They, too, need help getting back to their pre-pandemic lives.