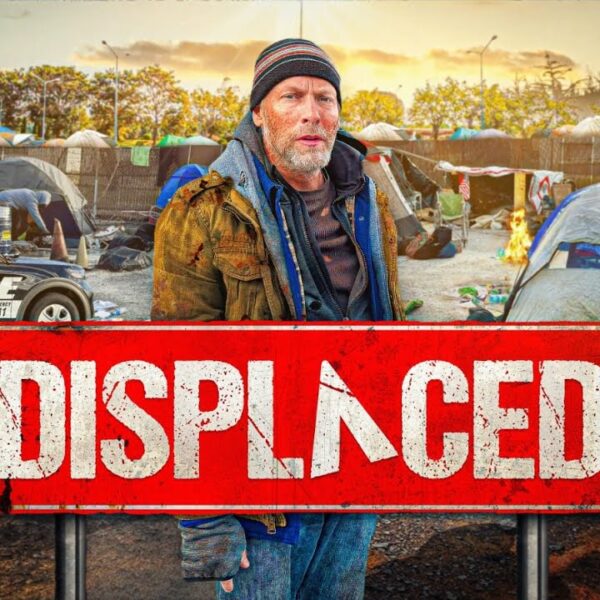

Big Banks are Banking on a Future Full of Renters as Investors Snap Up the Nation’s Inventory of Single-Family Homes

Families all across the country are struggling to make rent. In 2023, media sources claim that as many as 19 million renter households (equivalent to 40% of all renters) are in arrears. Not only are they behind, but they are also at the mercy of a housing system that’s been rigged against them from the very start.

As it turns out, big banks and corporations backed by private equity groups have been hoarding housing stock since 2009, ironically armed with taxpayer dollars and a hefty bailout gifted to them by our government during the Great Recession.

Many renowned political and economic experts have criticized that bailout, claiming it exacerbated income inequality and delivered a devastating blow to America’s already flailing middle class. What critics might not have known then is that the initial aftereffect was only the beginning.

The real damage from that bailout is taking place now as Wall Street and other corporate entities move into the rental sector and squeeze out low and middle-income earners from both sides, making it impossible to rent, own, or otherwise live in any form of affordable accommodation.

“I cried myself to sleep every night thinking, what am I gonna do?” said working mother Hannah Rogers in a tear-inducing interview with WWNYTV 7 News.

Hannah, a full-time working parent of four, described the heartbreak of not being able to make ends meet after being forced out of the home she had been renting for approximately nine years and facing a soul-crushing rental environment with unfathomable prices that were not at all in line with the median wage.

Hannah’s story may be heartbreaking, but unfortunately, it is in no way unique. The most tragic truth is that the extreme rent burden sweeping the nation is no accident. This is happening by design.

Built-For-Rent: While America’s Middle-Class Struggled, Wall Street Quietly Bought Hundreds of Thousands of Single-Family Homes

CNBC reports, “Institutional investors may control 40% of U.S. single-family rental homes by 2030.”

This projection comes directly from MetLife Investment Management, an institution with more than 150 years of investment experience to draw from. What’s more, many of these homes now owned by corporate entities were built to create built-for-rent communities, which is an increasingly and conveniently profitable endeavor now that the lion’s share of American workers cannot afford to purchase a home on their own.

Sources say the single-family rental industry is booming, creating what many experts regard as a “captive market” comprised of a new generation of perpetual renters.

Perpetual Renting is Financially Cheaper than Home Ownership, but it Comes at the Price of Freedom

With a captive market at their feet, private equity firms run by Wall Street and other corporate magnates now have the power to increase rental rates by astronomical proportions. The people will pay because they have no choice.

When the only alternative to paying exorbitant rental rates is homelessness, there’s no longer a cap on corporate greed. It is for this reason alone that a lack of affordable housing continues to loom as the leading cause of homelessness.

“In the early 1980s, the HUD budget for deeply affordable housing was cut in half while subsidies for wealthy whiter homeowners increased through the mortgage interest income tax deduction. So, we’ve been losing deeply affordable housing for basically the past four decades,” explained Eric Tars, who serves as Legal Director for the National Homelessness Law Center.

“That’s been happening both in urban areas and suburban areas,” he continued. “Paired with that disinvestment in social housing, there’s been a deregulation of the housing market and increased use of housing as a financial instrument – we call it the financialization of housing – where the primary purpose of housing is not actually housing individuals, and providing safe, affordable dwelling spaces for everyday citizens; but simply as a place for large venture capital companies and other corporations to make a profit.”

Tars also touched on the Great Recession and the notorious bailout as sources of anguish.

“This was exacerbated by the 2007 and 2008 housing and financial crisis, where many homes were foreclosed on,” Tars said. “Many of those mortgages were bought by the same venture capital companies that caused the financial crisis in the first place. They are now being turned into rentals. So, as the ability of people in the suburbs to own homes has decreased in some communities, more than half the homes that were bought over the past year were bought by institutional investors rather than individuals.”

Creating an entire generation of renters restricts the freedoms of everyday working Americans.

As the economic climate shifts yet again, they will now be at the mercy of the rising corporate landlord, making them more vulnerable to:

- Homelessness

- Eviction

- Rent-burden

- Economic hardship

- Hunger

- Overall loss

There is No Bargaining Power with Such a Dismal Supply of Affordable Homes. Please Contact Your Representatives.

Now that you understand what’s at stake, please talk to your local representatives about building affordable housing today. Future generations rely on your voice to shift the political tide in their favor.