America’s low-income earning renters are in the worst financial situation that they’ve seen in more than two decades, according to a new study from Harvard’s Joint Center for Housing Studies.

Using data from the 2021 American Community Survey, Harvard researchers found that renters earning up to $30,000 per year had approximately $380 in residual income each month after paying for rent and utilities. That total is about 22% lower than it was before the coronavirus pandemic and is the lowest that Harvard has measured in more than 20 years, according to the study.

“Declines in residual incomes have significant implications for household well-being,” the study said.

Over the last three years, the U.S. government spent billions of dollars to support renter households who lost income or work hours because of the pandemic. However, the efforts didn’t address the long-term issues renters still face.

Rents Are Greatly Outpacing Wages for Low-Income Households

One issue is that rents in some markets, such as Tampa, Florida, have increased much faster than local wages. For example, rents in Tampa have increased from around $1,700 for a one-bedroom in April 2021 to more than $2,200 as of April 2023, or by more than 30%, according to Redfin. But data from the Bureau of Labor Statistics shows that wages have only increased by about 10% over that time.

The dislocation of rent prices and wages often leaves renter households with less money to spend on necessities like clothes, food, and medicine. This trend is also widening the divide between high-income and low-income earnings households.

“Residual incomes for the lowest-income renter households have decreased 35% since 2001 as their incomes dropped and rents rose,” according to the study. “Higher-income households have benefited from rising incomes that outpaced rent growth, resulting in a 2% increase in residual incomes over the same period.”

Another issue the pandemic relief programs did not address is the increasing unaffordability of homes in the U.S.

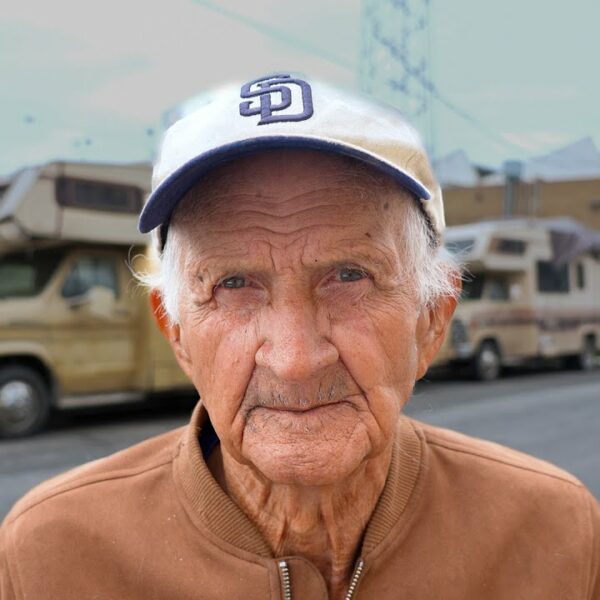

Rising home prices have not only made it more expensive to buy or rent, but it has also increased the risk that some renter households may become unhoused in the future.

In 2019 before the pandemic, Harvard found that about 67% of working-age renters spent more than the recommended 30% of their income on housing expenses. By 2021, that total increased to about 74%, according to census data.

Implementing Protections Could Prevent More Homelessness

President Joe Biden has previously proposed taking executive action to expand protections for renters as rents continue to increase. Some protections he considered include a federal law to seal eviction records, establishing a federal right to counsel in eviction cases, and prohibiting source of income discrimination.

A survey of landlords conducted by the Urban Institute in 2022 suggests that these protections could have a wide-ranging impact. More than 40% of landlords who responded to the survey said they are considering enacting tougher tenant screening protocols, including checking a tenant’s source of income, job history, credit score, and eviction history.

“In an increasingly competitive rental market, stricter tenant screening will create higher barriers to finding housing, especially for renters who have previously struggled to make on-time payments or have been evicted,” said Jung Hyun Choi, a senior research associate at the Urban Institute who conducted the survey.

In January, a coalition of more than 50 federal lawmakers, nonprofit executives, and advocates sent President Biden a letter urging him to protect America’s renters with an executive order. However, the president has not yet acted.

“In the absence of robust investments in fair and affordable housing, it is clear that additional timely executive action is needed to address the urgent issue of historically high rental costs and housing instability,” the letter reads.

How You Can Help

The pandemic proved that we need to rethink housing in the U.S. It showed providing additional support and protections for renters is a clear-cut way to reduce future increases in homelessness. It also showed that the country needs more affordable housing options, including manufactured homes.

That’s why we need you to contact your officials and representatives. Tell them you support keeping many of the pandemic-related aid programs in place for future use. They have proven effective at keeping people housed, which is the first step to ending homelessness.