Direct Donations Are Scarce in an Increasingly Cashless Society

Before credit cards and other cashless payment methods took over the marketplace, just about everyone had a few dollars or coins rattling around in their pocket, ready to be passed on to the first down-on-their-luck person who asked for them. Nowadays, though, many people have stopped carrying cash. Making these once run-of-the-mill gifts would now require a special trip to the ATM.

Digital payment services have positioned themselves as a solution to even this problem. But they also stand to profit.

Can Tech Fix A Problem Tech Created?

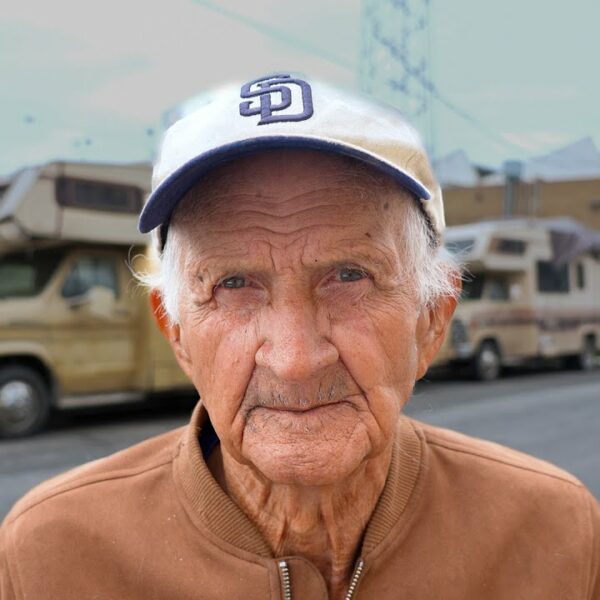

In response to this disappearance of cash, some panhandlers and unhoused people have pivoted to accepting donations in digital payment apps. But getting set up to accept digital payments has a lot more requirements and barriers to entry than putting out the proverbial cup.

Many digital solutions require you to have not only a device and an active phone plan but also things like bank accounts, mailing addresses, and various documents confirming your identity. All of this can be difficult to coordinate. And it’s not uncommon for documentation to become lost or destroyed during transitions between shelter or in encampment sweeps.

Are Digital Solutions Better Than Cash?

For those who can meet the requirements to open a digital payment account, it may seem like a new world has been opened. By accepting digital payments, one can receive donations from all over, not just from the people who physically pass by in a day.

Coupled with a social media presence, general likeability, and a little bit of luck with the algorithm, digital donations can become significant enough to offer a tangible quality of life improvement. It may not be enough to get into permanent housing. Still, some people find that they’re able to amass enough digital donations to pay for a hotel room more often, not worry about where their next meal is going to come from, and just generally take some of the stress off of their shoulders.

Do Potential Donors Really Want This Problem Solved?

Now, we get to the crux of the issue. The trend toward a cashless society has undoubtedly been detrimental to people who rely on cash donations from others to scrape by. But is this a problem for those potential donors? Or is the half-hearted “Sorry, no cash” merely a socially acceptable excuse for people who never intended to open their wallets in the first place?

The answer, of course, is both. Which way the data skews may be different for each person, but it is often a hard sell asking for digital donations in person anyway.

It’s not as if every person who pats their pockets ruefully when asked for cash is going to be excited to learn that there’s actually a digital payment option available. Many people will try to back out of that, too, having never intended to give or just being put off by the extra steps it takes to make a digital donation.

Passing a few dollars takes little thought, effort, and time while navigating an unfamiliar payment app and inputting all the right details can take a considerable amount of back and forth. The vast majority of peer-to-peer digital payment options we have today are designed to be clicked through online; they weren’t optimized for face-to-face use.

The Big Problem

At this point, it may sound like digital payment options aren’t ideal for panhandlers, but they’re better than nothing. Before we finalize that conclusion, we have to talk about the elephant in the room- fees.

Big tech doesn’t do much for free, and digital payment apps are no exception to that rule. Each transaction comes with a fee, which varies from app to app or transaction to transaction. While some allow you to pay the fee as the donor, the majority automatically pass the cost of the fee off onto the receiver, cutting into the donation amount each time.

Payment processing fees may not seem like much at first glance, but they can really add up over time. It’s always annoying to see a donation come through and start planning what to do with it, only to find you’re a few dollars short when it hits your account.

On the outskirts of Silicon Valley, the irony is extra thick. The multi-billion dollar tech companies making these apps profit off the very people they displaced- scraping dollars and cents off of the contributions to their continued survival given by those who can still afford the inflated housing costs of the area – for now.

In addition to fees, funds kept in these apps are more vulnerable than funds kept in a traditional bank account. Many people have been locked out of their accounts with no access to their funds for weeks or months for “suspicious activity” or with no explanation at all and left without any recourse.

So What Should We Do?

While digital payment apps have become a necessary evil for some people, we shouldn’t rely on them if we have another option. I’m not talking to the people who have had to adapt to a cashless society by any means possible. Of course, you continue to do whatever you need to survive and don’t need my blessing.

But those of us who are in a position to be able to give to others right now should keep in mind the downsides of digital payment apps. Be aware that many people have started accepting them out of necessity, but that in many cases, cash is still king. Talk to the people you’d like to give money to and find out what they’d prefer in their unique situation.

With a little bit of pre-planning, we can sidestep these issues for the most part. I recommend keeping a little bit of cash on hand at all times if you know you’ll want to give money to people who ask you for it. A quick trip to the bank or ATM at the beginning of the month or getting a little cash back on your next card swipe can set you up for seamless giving to anyone you encounter.