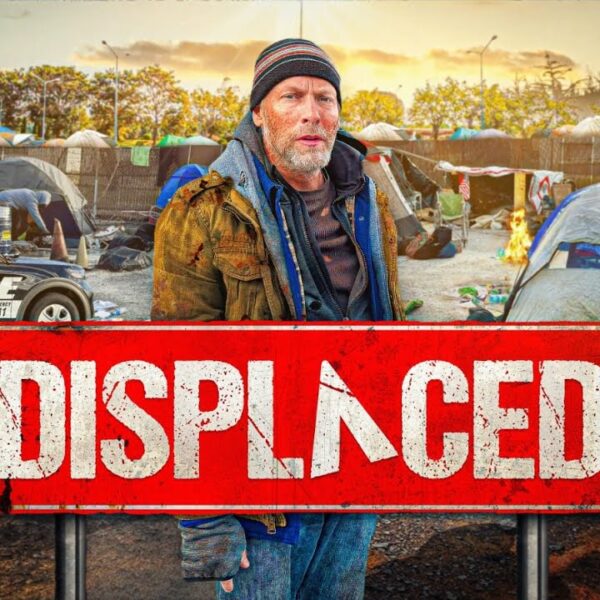

Never in our nation’s history has housing been more unaffordable than now. With market rates squeezing the middle class out of any plausible possibility of homeownership and pushing them into renter territory, the housing crisis has exploded into a renter crisis.

As rental rates continue to increase, the pool of available and affordable rental housing units dwindles. The result of this catastrophe? Millions of Americans endure homelessness every year.

This is a Supply ‘Problem’

As the housing crisis deepens, it’s important to point out that we are short on most types of housing, but especially affordable housing units. In most cities, with the rural Midwest posing as a notable exception, there are currently too many luxury apartment rentals on the market.

Contrary to popular opinion, luxury apartments are not inherently bad. Many economists hold fast to the view that in an environment where supply is falling millions of units short of demand, all housing is better than no housing at all.

In 2021, M. Nolan Gray of The Atlantic argued that opposing luxury apartment construction is a cunning NIMBY strategy. According to him, luxury rentals tend to create affordable housing through a process known as “filtering,” meaning that wealthier residents move on to the next new, shiny facility, leaving older, more affordable units behind.

According to Gray, “letting luxury development rip while buying up and restricting some of it to low-income residents might be the only scalable way to produce affordable housing.”

But, in this ever-evolving world of opulence, there is still such a thing as too many unaffordable housing units, whether they are amenity-filled high rises with all the bells-and-whistles of a five-star resort or merely middle-of-the-road apartment communities packaged as “luxury” to an unknowing middle-class.

There were high hopes for 2020 housing construction before the international pandemic swept the nation. Developers intended to build roughly 371,000 new housing units into the landscape, a record- number for new construction that hadn’t been hit since the ’80s. However, 80% of that housing was slated to fall under the luxury umbrella.

Imagine a world where 80% of developers cater to the top 10% of American earners while leaving everybody else in a lurch. This is the world we live in.

While much of the housing shortage can be chalked up to supply not meeting the demand, supplying only the top 10% of earners with housing they can afford is not only pretentious. It’s also redundant.

We’ve seen this same scenario play out again and again. It’s the one where low and middle-income earners are told to take another hit for the so-called greater good. At the same time, corporate America bails out everybody at the top until we are so inundated with resort-style urban development that the landscape becomes a sprawling sidewalk of empty high rises. Or, as Morgan Baskin described it, a landscape of “luxury ghost towns.”

New Housing Construction Has Become Unaffordable

Mid to small contractors have been suffering in silence since the Crash of 2008. As one contractor explained, the option to pick up building materials and pay the tab later became null and void following the Great Recession.

Any contractor who wished to survive had to rely on credit for capital. This increased the price of contractors and construction, a trend that took an even darker turn when inflation elevated the price of building materials.

Since then, developers and contractors have been striving to find innovative ways to build on a budget. Sometimes, they even succeed, but just because these contractors manage to build new housing for a low cost does not mean they are building affordable housing. Indeed, they are not.

Creative Approaches Save Money for Contractors, but Renters Still Pay in Full

In 2020, a Pennsylvania-based real estate agent partnered with a savvy investor. Together, they turned a $100,000 abandoned high school into a 31-unit apartment complex in just 18 months – an impressive feat by all measures.

The building is aesthetically pleasing to the eye, the kind of large-scale craft project that architects will marvel at for centuries. But there’s a catch. One-bedroom apartments in the renovated high school start at $1,400 per month, which is a couple of hundred dollars higher than the national median rental price of $1,216 a month.

Even an apartment listing at the median price is now unaffordable to half the US workforce. That couple hundred dollars extra could be a tipping point for even more people.

While the avant-garde style of some of these ambitious architectural projects may warrant a heftier price tag, we must acknowledge the lack of balance. Even when budget-friendly methods are utilized in new housing construction, the housing itself is still being brought to the market at largely unaffordable prices.

Perhaps, in the near future, wealthy renters will exit from one luxury condo into another due to this surplus and not leave an affordable apartment behind. Instead, they will leave an empty apartment most people can’t afford.

Tell Your Representatives to Make Affordable Housing Plans

With the 2024 election encroaching, political candidates are actively seeking ways to win over American workers. Now is an excellent time to ask them about their plans for building a new infrastructure with plenty of affordable housing. A huge part of this is creating incentives through tax credits and kickbacks for developers catering to low- and middle-income earners.