As Chicago Eviction Rates Soar Past Pre-Pandemic Norms, Minor Shortages on Rent Lead to More Homelessness

Pandemic-era protections staved off millions of evictions while the moratoriums were in place. Now, trouble brews in Cook County, Chicago as the number of evictions consistently creeps back up.

If recent history serves as a lesson in things to come, this could mean peril for renter households owing as little as $1,000. Here’s a look at the numbers fueling these fears.

The Sudden Loss of Pandemic-Era Aid and Rental Protections Has Left Cook County Residents in Distress

WBEZ Chicago reports that the relief afforded by pandemic-era aid was short-lived while the distress caused by the housing crisis rages on in Cook County, a region where pre-pandemic studies revealed slews of renters facing eviction for owing marginal amounts.

Just five short years ago, a looming eviction crisis could have easily been solved for the price of $2,500 or less per delinquent household. Tragically, that is no longer the case.

In present times, rising rental rates threaten to make rental assistance more expensive and the need for it even more widespread.

In 2023, Cook County rental rates surged by an astronomical 25% after the moratoriums were dropped, and it wasn’t long before evictions in that region started to spike. Now, as a toxic combination of corporate greed and lax tenant protections fill the air, Chicago-based renter households are also facing ubiquitous rent burdens. In fact, nearly half of all renters in the area meet this classification, as they are forced to spend more than 30% of their income on housing.

To that end, the region witnessed a 14% increase in its shelter bed utilization rate, not to mention a noticeable increase in overall rates of sheltered and unsheltered homelessness according to CBS News.

While experts blame the lack of affordable housing and an overall increase in the price of living for the jolting eviction trend, the brunt of the crisis is likely to be felt by the people who were not in any position to cause it, which translates to households living on the low-income end of the social spectrum.

According to the Chicago Sun Times, cost burden is a major problem for nearly half of all renters. However, families earning less than $35,000 a year are experiencing that struggle at unimaginable rates. Approximately 88% of households fitting that description are rent-burdened, and most are forking over more than half of their income toward rent.

If Recent History Repeats, Households Paying More than Half of Their Income Toward Rent Could Face Eviction for Owing as Little as $1,000!

Did you know that 18% of evicted renters in Chicago between 2010 and 2017 owed less than $1,000 in back rent? The problem hasn’t improved since.

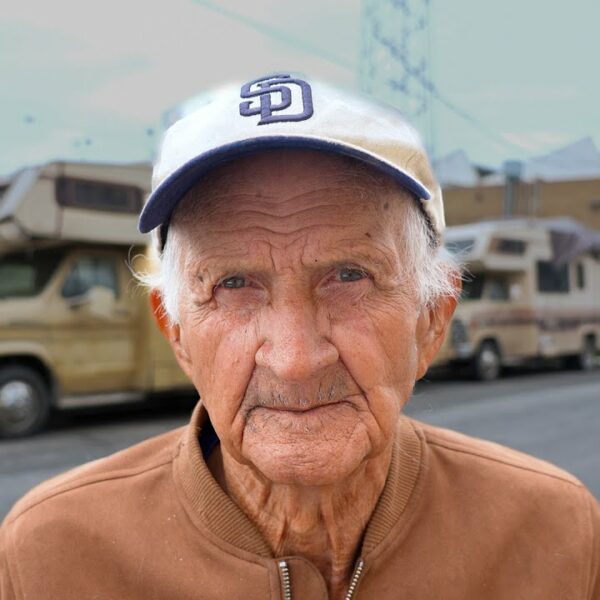

If you’ve ever wondered how far behind you need to be on back rent to get evicted, the answer might surprise you. In the Windy City of Chicago, for example, nearly 2 out of 10 evictions involve renters who owe less than $1,000. Before you think of homelessness as a “them problem” stop and ask yourself, have you ever fallen $1,000 or less behind on your rent? If so, this could just as easily be you.

The story is all too common in the Windy City. A struggling family of four barely scraping by with enough money to pay the $1,750 monthly rent on their two-bedroom apartment, hit dire straits when a minor medical emergency – a knee replacement surgery – left the family in arrears and fighting through the eviction court system to avoid homelessness.

Their case, like so many others, featured very little back rent owed, which should serve as a haunting reminder that most Americans living paycheck to paycheck are just one minor setback away from falling into homelessness.

“Although we are middle-class and white-collar, we are like a lot of people out there – practically no savings, a little 401k. When you think of the potential of someone going homeless, we are not necessarily what you see,” explained head-of-household TJ in a riveting interview published by the Lawyers’ Committee for Better Housing. This organization set out to quantify Chicago evictions and prevent them via a cash assistance program.

Unsettling Truths About Chicago Evictions

A series of reports entitled “Opening the Door on Chicago Evictions” highlighted many unsettling truths. For one, it was determined that nearly 2 in 10 Chicago-based evictions involved tenants who were $1,000 or less in rental arrears. Furthermore, according to the study, 63% of all evictions filed between 2010 and 2017 involved renters who owed less than $2,500.

The report illustrates the dire need for eviction prevention as well as the horrific consequences of widespread regional eviction.

Put simply, in 2019, Chicago was fighting a short-term eviction crisis that could have been generally solved by providing most at-risk families with $2,500 or less in eviction prevention rental assistance. Shortly after this report was released, the international pandemic shutdown and subsequent eviction moratoriums ensued. As a result of the nationwide moratorium, millions of evictions were avoided.

Tragically, however, that order was temporary. Flashing forward to 2024, much of Chicago is in the same position as before, with eviction levels reaching and, in some cases, exceeding the pre-pandemic rates.

Recommended Next Steps As Per Expert Advisors

Legal experts at the Lawyers’ Committee for Better Housing compiled a comprehensive list of steps to avoid more evictions and subsequent homelessness. Those steps include all of the following recommended actions:

- Increase in Eviction Diversion Funding

- Removing the harmful rent control ban that permits these double-digit rent increases to persist

- Production of more affordable housing

- Increasing the minimum and median wage to match current housing and rental market rates

These Steps Are Even More Necessary Now in 2024. Talk to Your Legislators About Following Through

The sad truth is that most Chicago-based families are being thrust into homelessness by way of eviction at unfathomable rates in 2024. With scant protections available for renters and limited eviction diversion funds, we will likely see an increase in family homelessness caused by eviction quite soon.

Talk to your legislators about following the blueprint provided above to prevent that predicament.