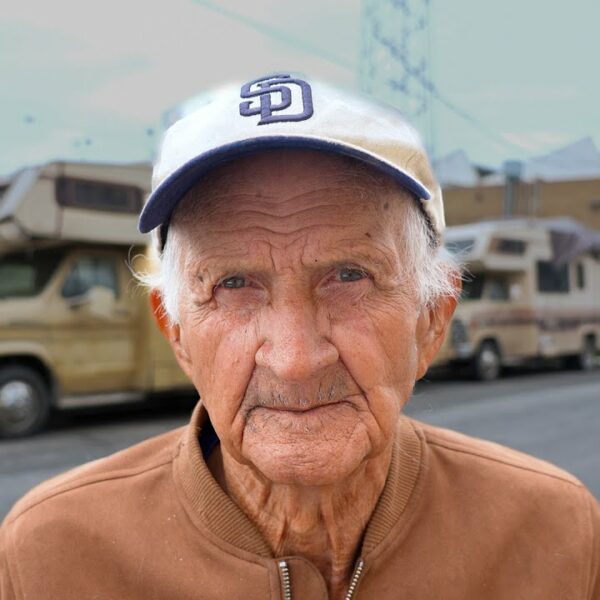

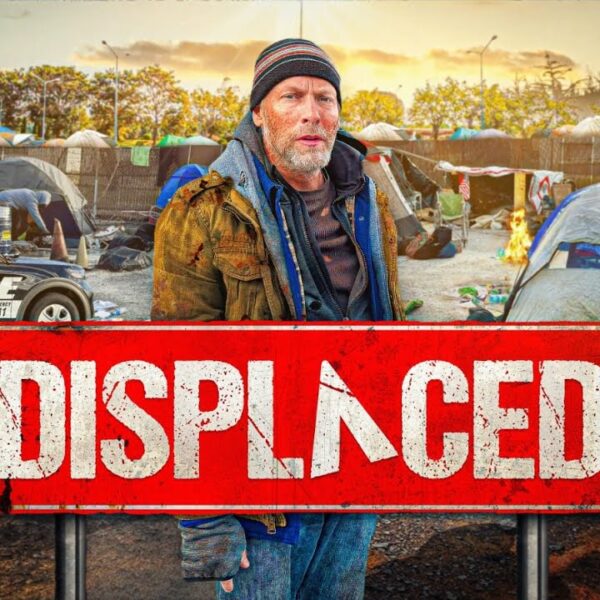

America’s homeless crisis is one of our top problems as a nation. Underreported and underfunded, the issue is wrought with myths and misunderstandings, particularly regarding its root cause: a lack of affordable housing.

To present the public with a clear picture explaining how housing has become the key driver of homelessness in the United States, The National Low Income Housing Coalition works diligently to release an annual report with up-to-the-minute information. This year’s report shows that almost 50% of America’s hourly wage-earning workforce does not make enough to afford a one-bedroom apartment without experiencing the hardship of rent burden.

Highlights from 2023’s ‘Out of Reach’ Housing Report

Aptly titled “Out of Reach,” the NLIHC’s investigative report on public housing proves that housing of all kinds is out of reach for the vast majority of American workers. This conundrum perpetuates cycles of homelessness.

In a nation where rental rates have grown at four times the speed of median wages, homelessness is the inevitable result. And while hundreds of thousands of people endure homelessness in a single night, new research by the University of Chicago shows that millions struggle through bouts of homelessness in the US every year.

Keeping this figure in mind, it’s evident that unaffordable housing is a problem that needs to be quantified and promptly solved. Here are some of the key findings that shed light on this issue:

- 60% of all hourly workers earn less than they would need to afford a modest two-bedroom apartment.

- Nearly half the US workforce can’t even afford a one-bedroom apartment without being classified as rent-burdened, which means spending more than 30% of their income on rent.

- 65% of America’s most common occupations, 13 out of 20 to be precise, pay an average wage that is not enough for rent on a modest two-bedroom apartment.

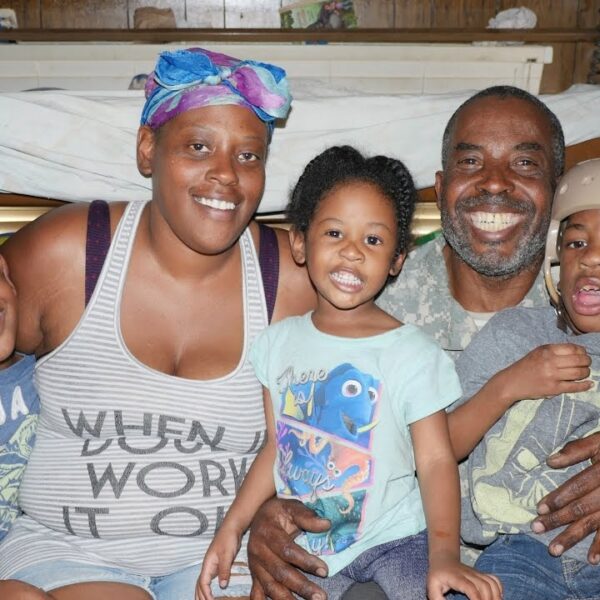

- Low-wage workers and ethnic minority workers bare the brunt end of the lack of affordable housing.

Wages Vs. Rent: How the Housing Wage is Determined

Each year, researchers from the NLIHC team study housing and labor trends to determine how much money workers need to make in each state to afford one and two-bedroom apartments. Those numbers, available for each state in the full-length report, are also calculated to reflect the national average. National averages indicate the following trends in America’s housing wages:

- Zero percent of all full-time minimum-wage workers can afford an average two-bedroom apartment.

- At the current market rates, 92% of full-time minimum wage workers can’t even afford a one-bedroom apartment.

- One-third of all American workers, laboring in 10 of the 20 most common industries, do not make enough money to afford a one-bedroom apartment anywhere in the nation.

Despite the current mainstream narrative, low-earning workers are not a small percentage of the US population. Indeed, one in three American workers earns a salary too low to afford even a one-bedroom apartment in any region across the United States.

A separate study by Brookings found that approximately 53 million American workers are classified as low-income. Millions more earn salaries that fall well below the housing wage, and states with lower housing costs often also feature lower wages.

On a national level, the necessary housing wage to afford a two-bedroom apartment without a rent burden is $28.58 per hour. Yet 62%, or approximately two-thirds of all American jobs, pay less than $20 an hour.

Henceforth, most American workers are at risk of becoming homeless now or in the near future due to the discrepancy in wages versus housing. Other factors pose more obstacles for specific groups of people.

Racial Disparities Persist Across Wages and Housing

People hailing from ethnic minority backgrounds are overrepresented in the homeless population. It should come as no surprise that they are also statistically proven to earn lower incomes.

For example, the median wage for a full-time Latino worker is a whopping $1.84 lower than the housing wage for a one-bedroom accommodation. This disparity also exists in the African American community, where the full-time median wage falls $.73 below the one-bedroom housing wage.

In stark contrast, median wages for full-time workers of Caucasian descent were well above the one-bedroom housing wage, precisely $2.23 higher than the necessary income level.

Factors Fueling the Affordable Housing Crisis Abound

Skyrocketing rental rates and stagnant wages are the main components fueling the affordable housing crisis. However, other factors play secondary roles. Some of the most significant issues making housing unaffordable for the vast majority of Americans include:

- Loss of pandemic-era benefits

- High rates of inflation

- Inadequate funds for other basic necessities such as groceries, toiletries, clothing, gas, and electricity

- Inadequate supply of affordable housing units

Talk to Your Representatives About Constructing Safe, Permanent, and Affordable Homes

As per the most recent data, it is clear that most American workers can no longer afford to keep a modest roof over their heads. This problem is systemic, and it starts with a shaky foundation.

The only way to dig ourselves out of this hole of homelessness is by building a better landscape that features safe, affordable, and permanent housing for all. Talk to your local representatives about their plans to make that dream a reality.