Broken Fences: ‘American Dream’ Takes Final Blow

In stark contrast to the 2008 recession, the plummeting economy caused in part by the novel Coronavirus hasn’t put a dent in the housing market. In fact, particularly in wealthy neighborhoods, housing prices are actually going up, even as employment numbers continue spiraling down.

The reason?

Market experts agree that it is lack of supply. In other words, the fact that we aren’t building enough affordable houses (or enough houses at all for that matter) is keeping the housing industry afloat but certainly at the expense of those who are newly unemployed. Here we have not only a widening wealth gap but an impending housing gap as houses in low-income neighborhoods depreciate and houses in wealthy and upper middle-class neighborhoods grow more expensive.

To quote Megan McArdle, a columnist at the Washington Post, “the housing market tells the story of two Americas. One has the educated and professional classes, most of whom work from home…The other America has the people whose job requires their physical presence.”

You can probably tell from the text which “America” is most vulnerable to homelessness.

More and more it becomes apparent that the future is unlikely to house a middle class or even have one, for that matter.

Essential Workers Fight for Moratoriums while America’s Top Earners Squabble Over Real Estate

Thanks to resourceful publications like The Washington Post, the divide in house purchasing power following the 2008 recession in America is well documented. It was determined in 2019 that the average working American could no longer afford to purchase a house in 70% of the nation’s market. In extremely impoverished communities, such as on Native American reservations, where lending is void and most property is communal, purchasing power plummets to nearly zero. In other words, for millions of miles, there are stretches of the American landscape where absolutely nobody owns a home.

And then there is the other America. The one the world sees on TV. The America that, in reality, belongs only to a coveted few. In that America, median listing prices are up 10.1% on average, which is the fastest growth the nation has seen in the past two years. In really swank places like The Hamptons, median listing prices have increased by a whopping 25%, as average single home prices climb to a record $1.1 million average and your everyday eight-bedroom mansion sells for a sweet $2.1 million, respectively.

How Home Ownership Translates to Even More Wealth for the Rich

We are living in unprecedented times in terms of inequality. Homeownership has reached record lows. Meanwhile mortgages are out of reach for the vast majority of American workers. Rents are steadily increasing year after year.

Henceforth we have created a situation where both options are unaffordable and neither option is profitable for the bottom 90% of American workers. The new national moratorium, without any emergency rental assistance, merely delays the inevitable for families vulnerable to eviction.

On the flip side of this, top earners are in the position to buy houses they can use as rental properties or run to as a refuge when fleeing the pandemic. This again gives them the upper hand in terms of safety. It also does much to secure their wealth.

Studies continue to prove that homeownership is only profitable when it is used for the purpose of renting and reinvesting. And while the construction of affordable housing faces even greater zoning obstacles, luxury rental real estate is all the rage.

Wealth Inequality Has Been Quietly Spreading for Four Decades – Equating to $50 Trillion in Losses for America’s Dwindling Middle Class

According to a new Trends In Income study released by Carter C. Price and Kathryn A. Edwards via the Rand Corporation, unequal income distribution has enabled our nation’s top 1% to swipe approximately $50 trillion from the bottom 90%. This, in turn, has given way to a whole host of avoidable economic issues. They range from Coronavirus fatalities to education inequality to, of course, homelessness.

In terms of sheer numbers, the ever-rising wage inequality causes the average American to lose somewhere between $48,000 and $63,000 per year. Behind those numbers though, we’re losing much more. We’re losing our right to reside in a safe and affordable home.

To Bridge the Gap, Affordable Housing Construction Must Resume and Wages Must Increase to Pace with Rents and Mortgages

This trend in prioritizing luxury condos while simultaneously tightening restrictions on the zoning and construction of affordable homes is only further crippling our nation.

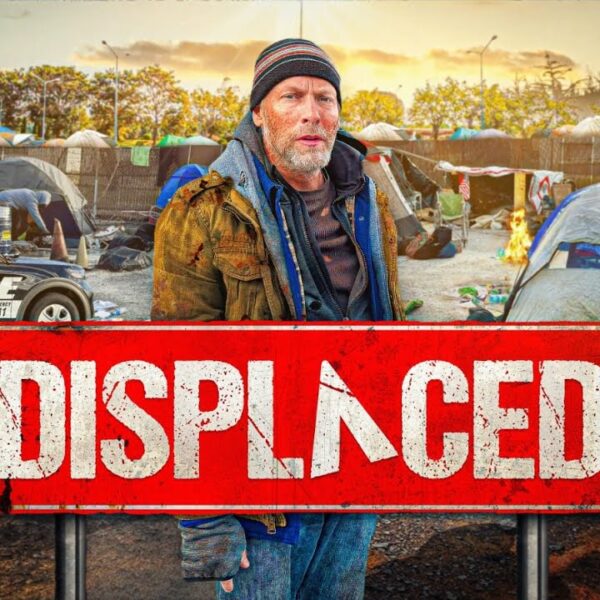

Homelessness is a nationwide crisis. And homelessness during the Coranavirus pandemic is a multi-tiered catastrophe.

Mass unemployment resulting from the shutdown has forever altered the United States. We now stand on a great divide in a space where we could truly become a nation that no longer houses the middle class … or worse. We could become a nation that no longer has a middle class. A nation where even housing is a luxury most of us will not be able to afford.

A COVID-19 related study released this year by Columbia University estimates that homelessness in America could increase by 45% in just one year. But that doesn’t have to be the case.