The hard-earned U.S. dollar doesn’t seem to stretch the way it used to – not at the grocery store, not at the gas pump, and certainly not in the housing market.

A growing number of United States residents (three out of four, to be precise) have taken a proverbial hatchet to the American Dream. While they acknowledge that home ownership is likely a fantasy for most, few know the exact rate by which rental prices are outpacing wages.

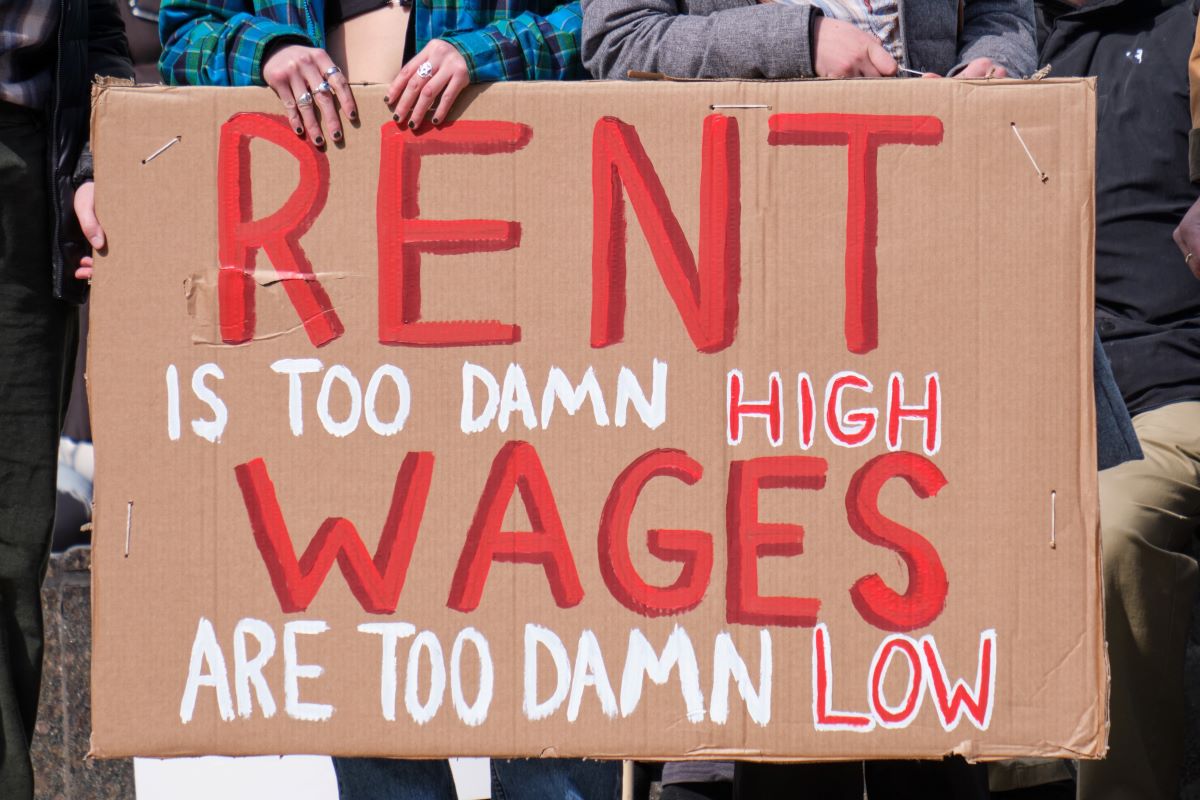

Rental Prices Are Increasing Approximately 4x Faster than the Median Wage

A recent analysis presented by Real Estate Witch revealed that national median rental rates increased by a whopping 149% in the past 35 years.

How much did wages increase in that same period? The answer is roughly 35%, exhibiting a rental price escalation that’s quietly growing 4x faster than the median wage. The study was compiled using data from:

- the U.S. Census Bureau

- the Federal Reserve Bank of St. Louis

- the U.S. Department of Housing and Urban Development

Among other findings, it was concluded that if rental prices and wages had grown at similar rates for the past 20 years, today’s average rental unit would cost 34% less than the current standard price. This discrepancy reflects a rent-to-income ratio that has almost doubled since 1985. Millennials perceive their dollar as being significantly less valuable when compared to the currency of previous generations, and they are correct in this assertion.

Experts suggest cutting back spending, picking up side jobs, and plea-bargaining with greedy corporate real estate companies to rectify the situation. The problem is that many households are doing some or all of the above. Burning the candle at both ends is only turning out to be a faster pathway into darkness.

Millennials Have Sacrificed More Than Previous Generations in the Hopes of Achieving Comparable Housing Goals. Studies Show They Are Delaying the Start of Their Lives.

The unaffordable housing crisis is at the heart of many other issues ripping this country apart at the seams. For the up-and-coming generations, many standard goals and aspirations have taken a back seat because nobody can afford a place to live.

A study released by the U.S. Census Bureau reports that a vast portion of the millennial population has opted to delay marriage and starting families due to crippling rental and housing costs and other financial concerns.

As patience gives way to doubt, housing organizer Tara Raghuveer describes a subgroup of citizens struggling with a “generational feeling of loss.”

Pew Research reports that most young adults continue to live with their parents, a fate the nation hasn’t seen since the Great Depression. While the affordable housing crisis is a rarely broached subject, the subsequent loss of financial freedom, family ties, and independence caused by the problem has given way to a generation that is sad rather than silent.

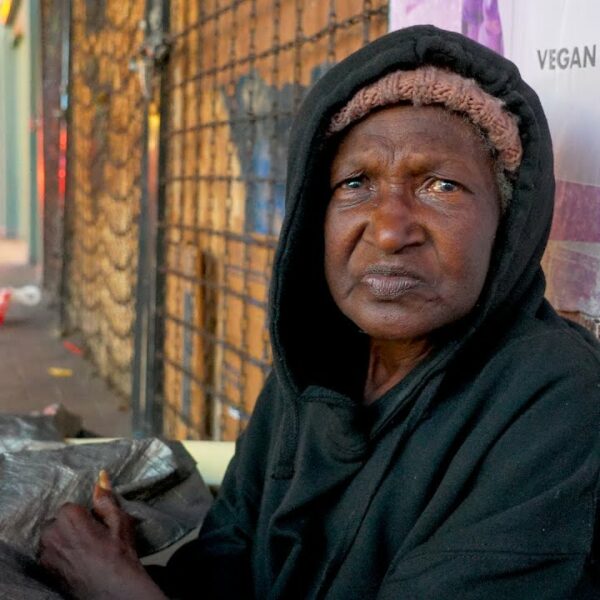

Depression creeps up across the country, where vacant luxury rental units take the place of absent affordable homes.

Capping Rental Rates or Raising Wages: Will Either of These Options Stop the Vicious Cycle?

Rent control, or capping rental rates, seems to be the most logical conclusion to the problem. Some experts claim that putting a cap on rental prices might discourage developers from constructing new homes, giving way to a national shortage that could exceed the current 7 million + homes nationwide. However, this argument feels somewhat hollow on the surface, and here’s why:

Skyrocketing rental rates directly result from the current housing supply shortage, and these developers in question are already profiting from not building affordable homes. Thus, they are already incentivized to cease construction with or without the rent control component that could be a life-saving safeguard for millions of at-risk renters.

Another possibility is to finally increase wages after all these years – all wages, not just the minimum wages, to ensure that low and middle-income earners can afford these astronomical rent increases. Experts, however, caution that such an effort could fuel further inflation, which would merely bring those rental costs back through the roof.

A third option suggested by some academics involves the application of a Universal Basic Income. While a UBI could reduce the blow of rental rates outpacing wages to such an extent, that package would only cover housing if permanent and affordable housing were recognized as a human right for all. At the time of this publication, this is sadly still not the case.

One Thing We Can’t Afford to Do Is Nothing at All. Please Talk to Your Representatives.

All of the crises in America are collapsing on top of each other. Wage stagnation has discouraged everyday workers from toiling away at jobs that don’t feature living wages, causing a labor shortage fueled by corporate greed.

The housing market crash of 2008 decreased housing construction, giving way to a supply and demand problem fueled by corporate greed.

As home ownership transitioned from an expectation to a luxury, low and middle-income workers turned to the rental market for their housing needs. The result was rental rates skyrocketing and creating a homeless crisis fueled by corporate greed.