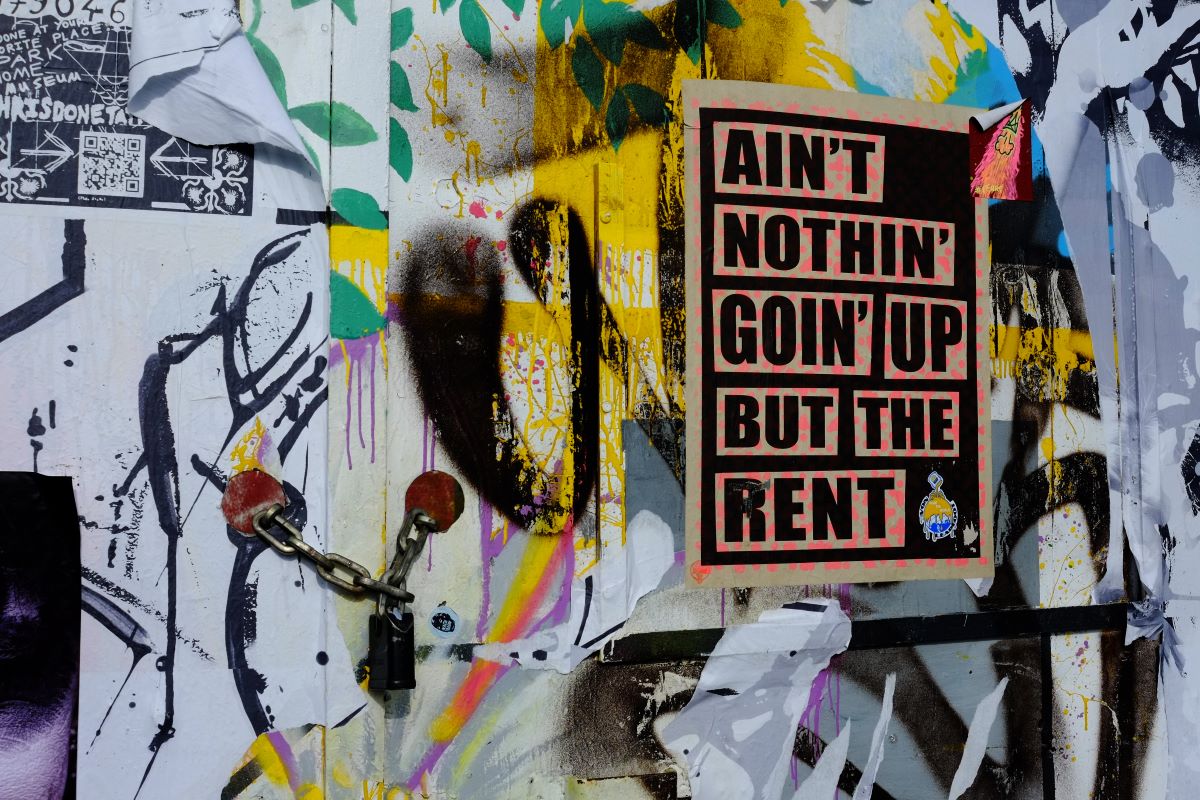

Sharply rising rents across the country are putting millions of Americans at risk of experiencing homelessness.

According to the latest market data from Seattle-based real estate firm Redfin, the average rent across the U.S. has increased 21 percent over the past year to $1,985 in November. For comparison, homeowners pay an average of $1,551 per month for their mortgages, assuming they made a 5% down payment.

And rents are rising fastest in areas that already have high concentrations of homelessness. For example, New York City, which has more than 45,000 people experiencing homelessness, has seen its average rent climb by 34.3 percent over the last 12 months up to $3,751 per month.

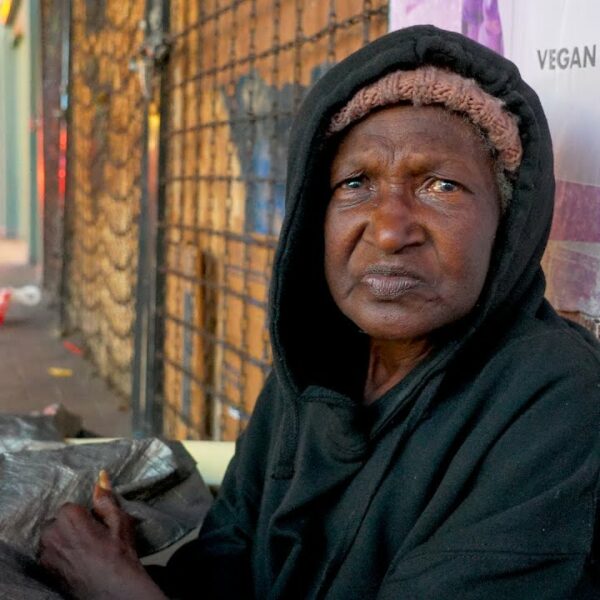

The same is true of other cities like Los Angeles, California, which has nearly 70,000 people experiencing homelessness. The average rent in Los Angeles was $3,422 in November, representing an 11.7 percent climb over the last year.

“First inflation came for the for-sale housing market, and now it is coming for the rental market,” Redfin Chief Economist Daryl Fairweather said in a statement. “Many people have been priced out of the for-sale market and are looking to rent instead, but that demand is pushing up rents.”

Pandemic’s Impact on Renters

According to research from the Terner Center for Housing Innovation at the University of California at Berkeley, the pandemic critically impacted renters. It found that one-in-five renters fell behind on rent and that the average tenant was in arrears by $2,200. Another 15 percent of renters fell more than six months behind on rent, and some owed as much as $4,000.

The federal government issued an eviction moratorium to stave off an increase in homelessness and created a rent relief program to alleviate the financial struggle many renters faced. Research by Princeton University’s Eviction Lab found that the federal moratorium, coupled with state and local replications, helped prevent more than 1.55 million evictions last year alone.

However, the emergency rental aid program’s inefficient rollout and the lack of critical infrastructure at the local level created more issues than it solved for many renters.

Some lawmakers in Alabama described the state’s efforts to provide relief as effectively “strangling” many of the state’s renters.

Similarly, renters in New York have had to endure a rash of technical difficulties and confusing application requirements to receive their aid. The state’s struggles with its rental relief program inspired Sen. Chuck Schumer (D-NY) to tell state officials to “move heaven and earth” to provide relief for renters in the state.

Delayed Homeownership

While the slow-moving rental relief programs have put millions at risk of experiencing homelessness, they have also forced many renters to delay becoming homeowners or forego the opportunity altogether.

Homeownership is a key vehicle of building wealth for many, particularly for low-income households and communities of color. That’s one reason why many housing agencies across the country are focusing on providing people experiencing homelessness with both stable re-housing options and pathways to homeownership.

However, the soaring cost of rent coupled with slow wage growth is putting homeownership out of reach for many. According to Redfin’s data, rent increases outpaced mortgage payment increases in 19 of the 50 cities it surveyed in November, with ten metropolitan areas seeing increases north of 28 percent.

Meanwhile, a growing number of people report facing the possibility of becoming homeless within the next two months because they are behind on their monthly payments. The Census Bureau’s latest Household Pulse Survey shows that 4.7 million people risk losing their homes to eviction or foreclosure, with California, New York, Florida, and Texas compiling the highest totals.

Lawmakers have tried to develop creative solutions to help renters access pathways to homeownership. For example, Fannie Mae, a government agency tasked with providing liquidity to the mortgage market, adopted a new rule in August to consider a first-time homebuyer’s rental payment history in their mortgage application.

Renters with either no or slim credit histories stand to gain from this change, the company said. It will also allow the company to provide “a more inclusive credit assessment,” though it is just “one important step in correcting the housing inequities of the past.”

How You Can Help

The pandemic proved that we need to rethink housing in the U.S. It also showed that aid programs work when agencies and service organizations are provided with sufficient funds and clear guidance on spending aid dollars.

Contact your officials and representatives. Tell them you support keeping many of the pandemic-related aid programs in place for future use. They have proven effective at keeping people housed, which is the first step to ending homelessness once and for all.