A first-of-its-kind study of state and federal eviction moratorium found the policies confer a broad set of benefits for housing-burdened rental households.

The Federal Reserve Bank of Philadelphia conducted the study in partnership with UCLA’s Anderson School of Management, Northwestern University, and the Bank of Israel.

Researchers found that the eviction moratorium was generally associated with declines in household debt as well as increases in both food security and mental health for renters.

Zip-code level credit card data also showed spending on credit decreased by 14 percent while debt payoffs increased by 16 percent. As a result, the study found many households saw small yet significant increases in their credit scores. Just one week of eviction moratoriums was associated with an overall score increase of about two points, the study found.

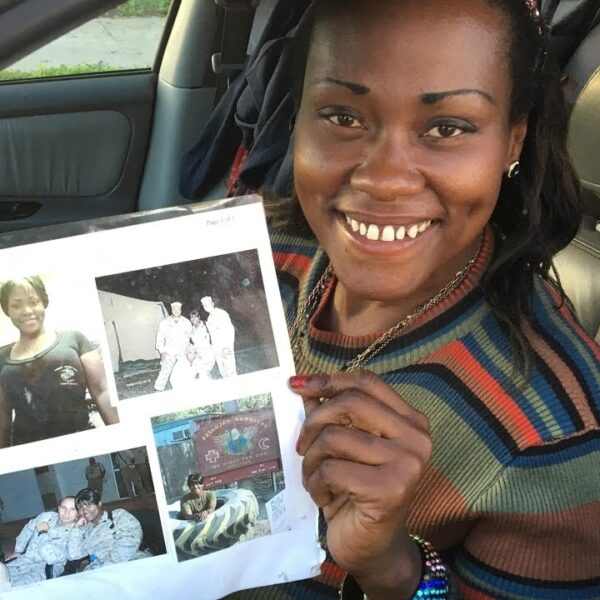

Similarly, food security increased for many marginalized communities. To be counted in this metric, a family must declare that they do not know where their next meal will come from most of the time. The study found 21 percent of Black families reported as food insecure compared to just seven percent of their White counterparts.

Eviction moratoriums were also associated with increased mental health. The pandemic resulted in a 25 percent increase in feelings of anxiety and depression among study participants, with the most significant increases among Black and Hispanic participants.

Once the moratoriums were in place, participants reported a 1.9 and 1.6 percent decline in depression and anxiety, respectively.

“Moratoria on eviction and related deferral of rent may have provided treated households with financial and mental relief in the form of positive shocks to household liquidity. Renters benefiting from such interventions could re-direct scarce resources to other immediate consumption needs, notably including food purchases,” the 45-page document concludes.

During the height of the pandemic in the spring of 2020, over 7 million unemployment claims were filed nationwide. That’s nearly 10-times greater than the number filed during the 2007 recession, according to the study.

Additionally, many people began cutting their credit card spending because of the broad shock of the pandemic to the economy. However, this decrease didn’t exactly translate to improved household financial conditions.

The study also found phrases like “food assistance,” “food stamps,” and “food benefits” increased by 62 percent on Google. This suggests many families were pooling assets to purchase necessary items.

The combination of housing instability and food insecurity led many states, cities, and counties to enact eviction moratoriums in the first place. However, according to The Aspen Institute, the haphazard implementation left between 30 and 40 million low-income Americans vulnerable to eviction or foreclosure.

For example, California enacted its eviction moratorium in March 2020 while Virginia waited until June. Researchers determined in November 2020 that this patchwork approach among states caused as many as 433,700 excess cases and 10,700 additional deaths in the U.S. between March and September.

Experts warn that allowing the eviction moratorium to lapse could result in another wave of COVID-19 infections. Doing so would force many people into doubling-up with family members or living in congregate shelters.

One issue with the first wave of moratoriums is that it only applied to renters in federally subsidized housing. The CARES Act and subsequent CDC orders applied to as much as 46 percent of renters nationwide, according to the Federal Reserve Bank of Atlanta.

It wasn’t until September 2020 that the CDC broadened its order to include all 43 million renter households in the U.S.

Once the policies went into place, rent deferment provisions allowed many households to focus on securing food and other essential items to weather the pandemic. These policies are associated with a two percent net increase in food security for BIPOC families who declared themselves as food insecure.

Homeowners were not spared from the ides of the pandemic either. Attom Data Solutions found foreclosure activity is increasing across the country despite the moratorium being in place. A total of 11,180 properties had foreclosure filings on them in March 2021. That’s a five percent increase from February.

Mortgage and rental deferment programs have certainly helped many families stay housed. But, an increasing number of households are at risk of experiencing homelessness as foreclosures increase.

Last year, the nation’s homeless population welcomed another 12,751 people to its ranks before the pandemic hit. That represents a total increase of 2.2 percent, the most significant spike in homelessness since the 1960s, according to HUD.

To help stem the influx of homelessness, the Consumer Financial Protection Bureau is drafting a plan to halt foreclosures until 2022. Meanwhile, lawmakers in several states are introducing bills to halt both evictions and foreclosures. For example, California’s Assemblyman David Chiu (D-San Francisco) introduced a bill that would protect renters from eviction for the rest of the year if they pay at least 25 percent of their rent each month.

The current federal eviction moratorium is set to expire on June 30.