Harvard Study Shows More Than 22 Million Renter Households Are Cost-Burdened Now That Pandemic Aid Has Ended

It’s getting harder for renters to afford homes across the U.S., and that could lead to a staggering increase in homelessness if elected officials don’t step in.

About 22 million renter households were cost-burdened in 2022, meaning they paid 30% of their income or more on rent and utility costs in 2022.

The total number of cost-burdened renter households represents an increase of 1.5 million households from 2021 and an increase of 4.9 million households since before the pandemic began in 2019, data from Harvard’s Joint Center for Housing Studies shows. About 80% of the cost-burdened renter households reported being “severely cost burdened,” meaning they spend 50% or more of their income on housing costs.

The increased cost of renting was driven primarily by unprecedented home price increases and flatlining wages spurred by the pandemic, Harvard research assistant Peyton Whitney wrote. In 2022, the median home price was more than 5.6 times greater than the median household income, which was higher than any point dating back to the 1970s.

The deteriorating affordability of America’s rental homes impacted renters of nearly every socioeconomic status, Whitney said. Even so, moderate-income earners and households of color faced the greatest affordability challenges.

“With Black and Hispanic households far more likely to be cost burdened, they are also more likely to face these tradeoffs than households headed by a white person, potentially forgoing food, childcare, or medication, while being unable to build emergency, education, or retirement savings,” Whitney wrote.

The increase in cost-burdened households also occurred when several federal and state pandemic aid programs ended.

For example, several states allowed their eviction moratoriums to lapse in 2022. Federal aid like the extended Supplemental Nutrition Assistance Program and emergency rental assistance declined before ending in March 2023.

Whitney noted that homeowners were not immune to the home price increases caused by the pandemic either. About 19.7 million homeowners reported being cost-burdened in 2022, which was up from 19 million in 2021 and 16.7 million in 2019. About two-thirds of the increase in cost-burdened homeowner households was by people who reported being “severely cost-burdened.”

Low-income earning homeowners bore the brunt of the pandemic’s home price rally. About 72% of homeowners earning $30,000 per year or less reported being cost-burdened, an increase of 4.2% compared to 2019. For comparison, half as many homeowner households earning more than $30,000 per year reported being cost-burdened, the data shows.

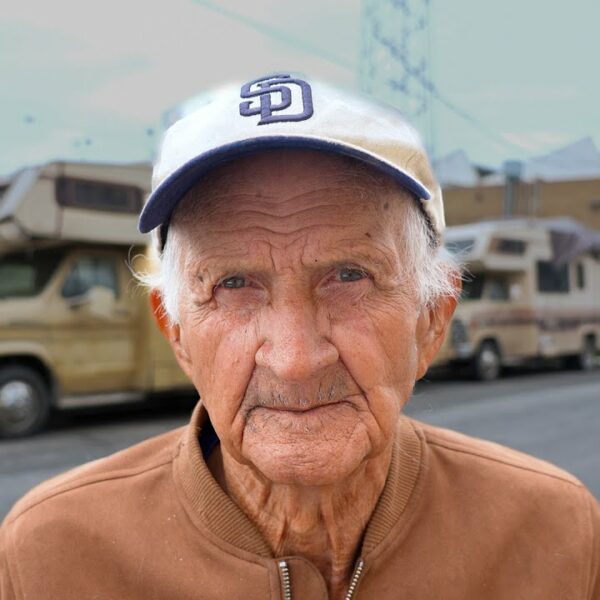

“Worsening affordability for low-income homeowners was driven by a growing population of older adults on fixed incomes; the share of homeowners over age 65 increased much faster among low-income homeowners than homeowners with higher incomes,” Whitney wrote.

A lack of affordable housing is one of the key drivers of homelessness across the country.

With so many households being cost-burdened, it seems likely that a number of these households could fall through the cracks into homelessness if they don’t receive additional support.

The latest point-in-time count shows there are more than 650,000 people experiencing homelessness in the U.S., which represents a climb of 12% year-over-year. The rise in homelessness was largely due to a growing number of people experiencing homelessness for the first time, according to the data.

“We’ve made positive strides, but there is still more work to be done,” HUD Secretary Marcia Fudge said. “This data underscores the urgent need for support for proven solutions and strategies that help people quickly exit homelessness and that prevent homelessness in the first place.”

How You Can Help

Now is not the time to be silent about homelessness in the United States or anywhere else. Unhoused people deserve safe and sanitary housing just as much as those who can afford rent or mortgage.

Poverty and homelessness are both policy choices, not personal failures. That’s why we need you to contact your officials and tell them you support legislation that:

- Streamlines the development of affordable housing

- Reduces barriers for people experiencing homelessness to enter permanent housing

- Bolsters government response to homelessness

Together, we can end homelessness.