A recent spike in car repossessions and home foreclosures has created a not-so-perfect storm for average-income earning Americans.

Many experts hold to the theory that we are not currently in a recession. However, it’s worth noting that the GDP rose at a much lower rate than projected, which suggests the US could enter a period of stagflation. While not the same as a recession, stagflation is still marked by high inflation rates and stalled economic growth.

This stalling of the US economy harkens back to the downturn of 2008, an era known to most as when the real-estate bubble officially burst.

Today, in a post-pandemic economy where housing prices and inflation are at an all-time high and wages remain dismally stagnant, the bubble that might very well burst is a transportation bubble, as fewer and fewer American workers can even afford to live in their cars.

Pump the Brakes: Car Repossessions are Increasing at Accelerated Rates

Data from the Fitch Ratings December 2022 report shows that the number of subprime borrowers who are 60 days or more delinquent on their auto loans has doubled since May of 2021, making auto loan delinquency an even bigger problem than in 2008.

Several factors are fueling this crisis. Among them are:

- High inflation

- Unaffordable gas prices

- Wage stagnation

- A nationwide decrease in available savings now that pandemic-era protections have been removed

- Higher prices for automobiles, with the average vehicle now costing 30% more than it did just three years ago

- Higher overall rates for auto loans

Behind the Wheel: New Car Prices Reach a Record High

In September 2022, CBS News reported that car prices reached their highest average in history, with the average vehicle costing almost 50 grand. Dealership markups as high as $10,000 over the sticker price are common, and used vehicles are being priced up at an increased rate of approximately 11% year-over-year.

According to experts, more than 3 million would-be purchasers could not buy vehicles in 2020. Another 1.2 million car owners fell prey to repossession in 2022 alone. This trend has left many Americans falling behind – behind in the housing market, behind in the rental space, behind on their grocery bills and utilities, and also behind at the wheel.

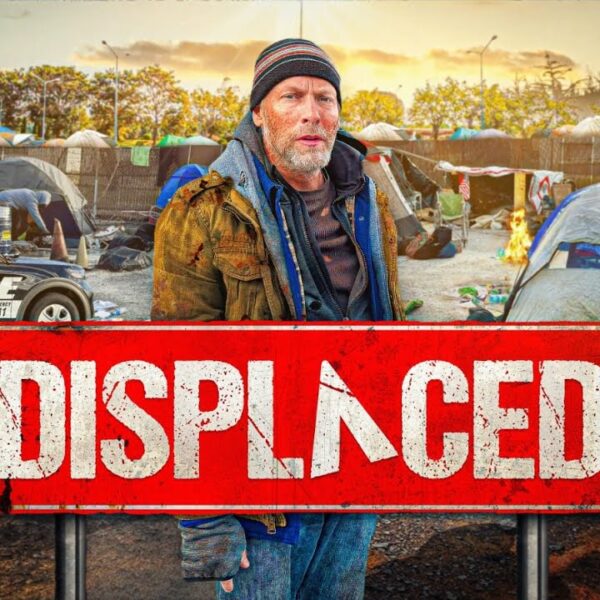

Vehicular Homelessness is at its Peak

In 2021, vehicular homelessness, a social dilemma where an individual or family is forced to live out of a car, reached a historic high. Some experts have gone so far as to refer to vehicular residency as the “new form of affordable housing.”

Now, with millions in danger of having their vehicles repossessed, there will undoubtedly be a growing population of people who can’t even afford to live in their cars. Forget safe parking and social service programs.

These individuals will undoubtedly be forced into even more obscure and dangerous variations of homelessness, such as sleeping right on the concrete where they once spun their wheels.

In addition to losing that family RV they once called “home,” a repossession also means being subject to a lack of transportation. Did you know that homeless people who lack transportation suffer from the following social ailments?

- Job loss due to inability to get to and from work

- Loss of financial and healthcare services

- Difficulty getting in and out of emergency shelters

- Inadequate bus routes make it challenging to access necessities such as food, toiletries, clothing, etc.

Lastly, it’s important to note that a lack of transportation is proven to keep people who are already homeless stuck in the vicious cycle of homelessness. Their wheels might be spinning, but the destination of permanent housing cannot be achieved.

Driving in Circles: How Losing a Vehicle Can Pave a Pathway into Homelessness

Not only could a slew of auto repossessions create more visible unsheltered homelessness for people who already have no place to live, but it could also force people not previously homeless out of a stable housing environment.

A 2014 study published by the Urban Institute identified a clear link between having access to transportation and having positive permanent housing outcomes.

The study, entitled “Driving to Opportunity,” compared two decades of housing voucher and automobile data. It concluded that vehicle ownership aligned with positive permanent housing outcomes for Welfare to Work voucher recipients. One of the study’s highlights comes in the following quote:

“Over time, households with automobiles experience less exposure to poverty and are less likely to return to high-poverty neighborhoods than those without car access.”

Likewise, losing access to an automobile through repossession can lead to all of the following negative outcomes that could potentially create more vulnerability to homelessness:

- Job loss

- Limitations on employment locations based on transit routes

- Inability to work shifts during times when transit isn’t running

- Bad credit as a result of the repossession can pose barriers to obtaining housing even if the person remains employed after their car is confiscated

- Loss of savings due to repossession charges, storage fees, and more

Talk to Your Local Legislators Before It’s Too Late

In 2022, just one year ago, President Biden claimed that some shifty politicians wanted to make working-class Americans too poor to afford cars to drive. At the time, the quote got very little press.

In light of recent revelations, however, it seems some shifty politicians seek to pummel the middle class out of housing, driving, and sustaining even a modest life.

Please contact your local legislators and demand they make housing a human right before American workers are driven out of the housing market, the auto market, and the job market all at once.