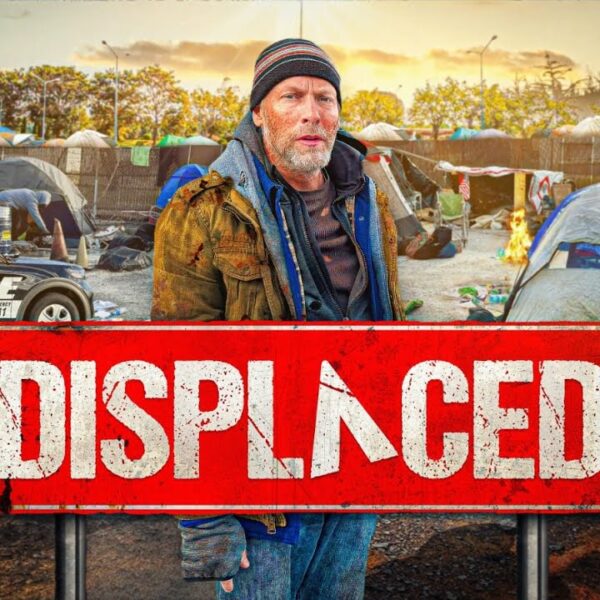

Are single people more at risk of falling into homelessness? Thanks to something known as “the singles tax,” they probably are. Read on to learn more about the astronomical expense of being single and how it could potentially serve as a pathway into homelessness.

A 2023 survey suggests the top stressors for single adults are all financial. This is because being single is more expensive (and financially risky) than being a couple. Some have even gone so far as to coin a new term — “the singles tax.”

Our economy continues trending toward singlehood, often to the detriment of young people too strapped to bear the financial burdens of an increased cost of living alone.

So, How Much Is This ‘Singles Tax’ They Speak Of?

Economists say it costs about $6,000 more per year to be single. That number is even higher for renters, who fork over a whopping $7,000 extra each year for housing alone, not to mention other expenses.

“I don’t have anyone,” says TikTok user eeriespector in a heart-wrenching video where she’s bordering on tears. “I have no safety net. If I were to get very ill or extremely injured or anything like that, I have no one. I am completely alone. If I need help paying a bill, if I get behind, there is no one,” she sighs, staring out into the abyss of netizens who have only tuned in to be entertained.

While eeriespector’s plight is tragic, her circumstances are not unique, and the concerns she raises about falling behind or becoming injured are not at all unfounded in this day and age.

As it stands today, most people, regardless of their relationship status, are one paycheck or one emergency away from homelessness. Adding a “singles tax” to this is taxing for everyone involved.

Experts Say Nearly Half of All People Will be Single by 2030, Which Might Cost Them a Whopping Million Dollars in ‘Singles Taxes’

According to Vox, researchers Lisa Arnold and Christina Campbell created an algorithm based on factors like housing prices, social security income, healthcare costs, and federal taxes to determine how much more money a single person would have to fork over in a lifetime. The results of this were shocking.

Using a sliding income scale, it was determined that an individual making $80,000 a year would wind up spending an extra million dollars just for being single. This is because prices are not evenly split and buying in bulk (something families do) is ultimately more cost-effective.

One of the most significant expenses a single person incurs is housing. Be it a mortgage, rental unit, apartment, or condo, the cost of housing for a single person is far from half of what a couple might pay.

Think of it this way. According to Statista, the national average price of a two-bedroom apartment is approximately $1,317 a month. Meanwhile, a one-bedroom unit goes for $ 1,149 a month. Therefore, if a couple splits the price of a two-bedroom flat, they each pay approximately $658.50. A single individual is footing the entire bill, paying well over $1,100 monthly in housing costs alone.

Not being able to split rent or buy in bulk comes at a price, but there’s another component that was hinted at in the TikTok mentioned above – emergencies.

Whether they come in the form of an unexpected illness, a sudden loss of employment, or an unforeseen auto repair need, emergencies can cripple a person who is already living alone. Statistically, single people are paying more and saving less, making them less financially equipped to handle unexpected expenses.

People in relationships don’t just save more money but also tend to have more things because their possessions, abilities, and assets are combined.

A single person who can’t afford a new starter on their vehicle risks losing their car and possibly their job due to a lack of access to transportation. Eventually, they risk losing their home when they can no longer afford rent because they’re unemployed.

A person in a relationship who needs a new starter and doesn’t have the money has a high chance of being able to borrow the funds from their spouse. If they can’t borrow, and their spouse has a car, they won’t lose their job because they have another reliable vehicle they can use to get to work.

Having two of everything is a rarely spoken-of social safety net that comes complimentary with coupling up. And it isn’t just assets that can be pulled.

If a person in a couple becomes seriously ill and is unable to work, their partner can put in extra hours to make up for the lost compensation. The same applies to injuries, emergencies, maternity leaves, and more. Everything gets pulled – the resources, the time, the energy – and in the end, that all adds up to money, even if it doesn’t start that way.

Gen Z-ers face a previously unheard-of dilemma. Many are delaying marriage and relationships because, financially, they can’t afford to get married or buy houses or, in some cases, even pay to go out on dates. But this strategic move is ultimately costing them even more because being single in this tumultuous economy is exceedingly more expensive.

Talk To Your Local Lawmakers About Drafting Protective Legislation That Will Decrease the Cost of Living and Give Future Generations a Fighting Chance

The future leaders of our world deserve your voice in unison with theirs. As we speak, your local legislators are hard at work promoting template legislation that criminalizes homelessness and cripples the middle class.

They have yet to address the housing crisis, the homeless crisis, the wage stagnation crisis, or any of the other factors that are plaguing our youth. Contact them today and demand they take action by drafting more protective legislation and making housing a human right.