Amid recession scares, bank collapses, and unprecedented inflation rates, the number of first-time homebuyers in the US just reached the lowest in recorded history – according to a nationwide tally running for over 40 years.

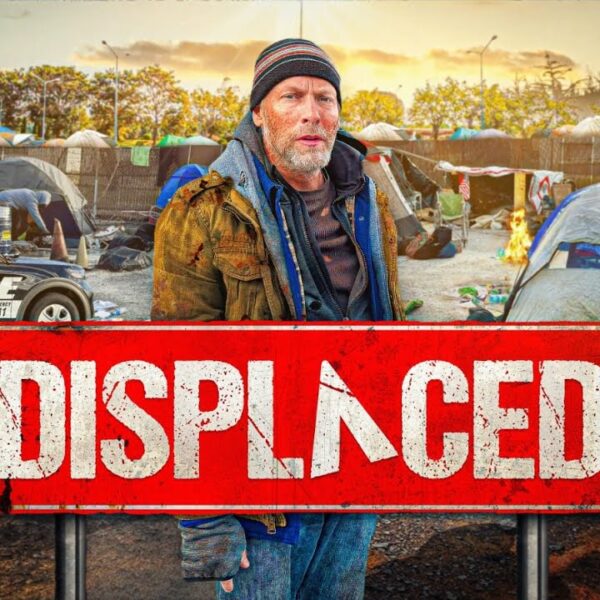

Here’s how this underreported problem creates a revolving door into homelessness for future generations.

The Pressing Issue of Hidden Homelessness

Hidden homelessness is a pervasive problem nationwide.

You’ve seen the streets of Kensington, Philadelphia, and Skid Row, California. These are the places mainstream media often references to highlight the homeless crisis. Along these pathways, it is not uncommon to encounter things like mental illness and drug addiction, secondary causes of homelessness that the media wishes to report on first.

Rarely told are the tales of the 31-year-old breakfast servers and retail workers aging in their parents’ basements while waiting for their lives to begin. Like the unsheltered homeless populations seen on city streets, these individuals are effectively homeless. The fact that their homelessness is hidden on a sofa bed doesn’t make it any less of a reality.

Stories of hidden homelessness are of equal importance. They help us understand the bigger picture.

Regardless of what the PIT count conveys, homelessness is more than just a snapshot of a street corner on a frigid January evening. It is a crisis happening right here in our homes as millennials and Gen Z-ers are increasingly kicked out of the mortgage market one hard-earned penny at a time.

The National Association of Realtors Reports That the Percentage of First-Time Homebuyers Has Hit Rock Bottom

In 1981, The National Association of Realtors published the first in a series of reports entitled “The Profile of Homebuyers and Sellers.”

That in-depth analysis of the housing market would be used to document real estate trends for the following four decades. Indeed, it is still in use to this very day.

“The Profile of Homebuyers and Sellers” provides insights into the annual market, including buyer and seller profiles and characteristics. According to that report, the housing market reached a record low in 2022 when the share of first-time homebuyers declined to a dismal 26% for the first time.

Notedly, this rate is nearly half the percentage of first-time home buyers in 1981, as per information from that year’s NAR report.

This is an important detail because 1981 was, in many ways, a comparable year to 2022. Like potential purchasers in this era, first-time homebuyers in the early 80s were grappling with a recession – theirs was informally referred to as the “Reagan Recession,” an economic nosedive marked by high rates of inflation, exorbitant gas prices, and soaring unemployment, all standing on the heels of the 1979 energy crisis.

Much like today, several bank failures occurred in the early 80s, and inflation peaked in double digits, skyrocketing to a jaw-dropping 13%. Yet, unlike today, people were still buying houses at almost double the current rate. Why the glaring discrepancy?

The Lack of Affordable Housing is the Factor Making the Modern Market Different

When reviewing the latest reports of home purchases, experts cite all the usual suspects for this year’s lack of participation overall:

- high inflation

- higher home prices

- low wages

- real estate investors stocking up and cashing in

- zoning restrictions

- and the list goes on

Many of the items listed are issues equally prevalent in 1981 or, in the case of inflation, even more so. However, if you read between the lines, you’ll find one different thing – lower inventory.

To quote The National Association of Realtors Vice President Jessica Lautz:

“It’s not surprising that the share of first-time buyers shrank to the lowest level ever recorded given the housing market’s combination of historically low inventory, persistently high home prices, and rapidly escalating interest rates.”

Something Else Has Changed – First Home Purchases Are Happening Later in Life

Further analysis of the housing market reveals that first-time home buyers are not just becoming rarer, but they are also getting older. Indeed, the median age that a first home purchase takes place is also the highest it has been in history, at 36.

Experts posit that saving for a down payment is taking significantly longer, to the point where many potential purchasers are forced to wait until wealth gets transferred from an elderly member of the family who passes it down through illness or death. This phenomenon could also explain why families lacking generational wealth are increasingly being locked out of the housing market altogether.

When Hidden Homelessness Becomes Chronic Homelessness

The revolving doorway between hidden homelessness and unsheltered homelessness goes unnoticed, but those who pass through it are forever changed.

Recent studies show that collectively, Americans are shifting toward an out-of-sight, out-of-mind mentality regarding homelessness. For this reason, it’s important to note that hidden homelessness doesn’t always remain hidden.

Think about it. If a person is forced to spend years or decades in the basement or living room of a family member, not because they refuse to work, but because the vast majority of American jobs no longer pay a living wage, there’s bound to be some friction. If the situation gets too intense, hidden homelessness becomes a gateway into other, more visible types of homelessness, such as unsheltered and chronic homelessness.

Worse still, that situation is more difficult to escape once other options have been exhausted and kinship ties have been severed through previous financial woes.

Suppose an individual or family transitions from hidden homelessness to unsheltered homelessness. In that case, they become even more at risk of passing those financial hardships on to their offspring and thus creating a crisis of generational homelessness.

Talk To Your Legislators About Incentivizing the Construction of Affordable Homes

There are many ways to incentivize builders to construct more affordable homes, from tax breaks to the lifting of zoning restrictions, and more. How does your local legislator aim to curb the current housing crisis? Contact them today and find out.